Blog

California Mileage Reimbursement: Covering the Real Costs of Driving for Work

If you’ve ever driven across town to meet a client, pick up supplies, or cover a last-minute site visit, you know those miles don’t come free. Gas, maintenance, insurance—each trip quietly chips away at your wallet. That’s why California expects employers to pay workers back when personal cars are used for work. Nakase Law Firm Inc. has guided many employers and employees through the legal requirements of California Mileage Reimbursement, emphasizing the importance of compliance with state labor laws. And yes, that simple idea—“use your car for work, get paid back”—is the heart of this topic.

This is more than a line item on payroll; it’s a fairness check. If your time and tools keep the business moving, shouldn’t the car you use be part of that? California Business Lawyer & Corporate Lawyer Inc. has provided legal insights into the evolving landscape of California Mileage Reimbursement 2025, especially with the rising costs of transportation and the increased focus on employee rights. So, if you’ve wondered whether that weekly client loop should be reimbursed, you’re asking the right question.

The law in plain language

California Labor Code Section 2802 says employers must pay employees back for necessary costs tied to their job. Using your own car for a work errand counts. A quick picture: you drive ten miles to deliver a proposal, swing by a vendor, and head to a second meeting. That’s not just a splash of fuel—it’s wear on tires, oil, and depreciation inching up each mile. The law recognizes all of that. Commutes from home to your regular workplace, though, sit on the personal side of the line, so they’re not reimbursed.

How the IRS rate fits in

Each year, the IRS publishes a standard mileage rate meant to reflect average vehicle costs. Many California employers pick that number as their benchmark because it keeps things simple and helps avoid arguments. The state doesn’t force that exact rate, but paying far below it often sparks complaints. Workers can argue that the lower rate doesn’t truly cover their costs, and courts tend to look closely at the math. So, using the IRS figure (or a bit more) keeps things clearer for everyone.

Policies that keep people on the same page

Written guidelines make a world of difference. When a team knows what counts, how to log miles, and when to submit, reimbursement stops feeling like a mystery. Helpful policies usually cover the rate, the type of proof needed (a simple log or an app record works), when to file, and which trips qualify.

Picture the difference. In one office, Mia drives to three client meetings and shrugs, unsure if the miles will be paid. In another, she opens an app, taps “start,” and later submits with two clicks. The second office doesn’t just feel smoother; it avoids confusion and cut-off claims. Which setup would you rather have?

What workers can do right now

If you’re the one driving, keep clean records. A small notebook in the glovebox still works, and so do mobile apps that pull the mileage for you. Jot the date, start and end points, purpose, and total miles. Then submit on schedule. If the payback number looks off, ask for an explanation. Workers have successfully challenged low reimbursements, and clear documentation makes your case stronger.

Common snags for employers

A few patterns show up again and again:

- Treating real work trips as commuting and refusing to pay.

- Forgetting to update the rate when the IRS posts a new one.

- Letting mileage records scatter across emails and sticky notes.

- Paying one group but overlooking another, which invites complaints.

None of these issues are hard to fix, and it’s far easier to prevent them than to patch things later.

Why this touches morale and budgets

Fair reimbursement carries weight. When employees see their costs covered without a struggle, it builds trust. On the flip side, skimping on miles tends to linger in people’s minds. And here’s something many teams learn the hard way: paying a clear, fair rate usually costs less than fielding a complaint, hiring counsel, and dealing with fallout. So, this isn’t only a legal box to check—it’s a day-to-day business choice that shapes culture.

What 2025 looks like on the road

Costs are higher across the board, and teams are more spread out. That’s part of why California Mileage Reimbursement 2025 draws attention. People are better informed, and they’re more likely to ask for correct treatment. On top of that, mileage-tracking apps have become common—tap “start,” do the visit, tap “stop,” and the log is done. That can feel a bit watchful to some folks, and that’s understandable. Still, when used with care and transparency, these tools reduce arguments about the number of miles and keep reimbursements moving.

When rules get ignored

Skip fair reimbursement, and trouble shows up sooner than you think. A sales rep puts hundreds of miles on a compact car every month. A field tech loops between job sites all week. If those miles aren’t covered, frustration grows—and so do claims. Workers can go to the Labor Commissioner or band together in court. Back pay can pile up fast, not to mention legal fees and the headache of public scrutiny. No one sets out to land there, so clear steps today matter.

A simple, workable plan

Here’s a path that keeps things smooth:

- Pay at or above the IRS standard rate so people don’t feel shorted.

- Use a reliable mileage tool or a clean log template; make it easy to submit.

- Train managers to separate commuting from real work travel, with examples.

- Revisit the policy once a year and refresh the FAQ with common questions.

- Keep the tone open—invite questions early, not after frustration builds.

To ground this with a real snapshot: a small design studio gave its team a one-page policy, a basic app, and a monthly reminder. Claims became consistent, people stopped guessing, and end-of-quarter cleanups took minutes instead of hours. Not flashy—just steady.

A few everyday stories

Think of Jordan, a nonprofit coordinator. On Tuesdays, Jordan checks in with a partner school, then detours to a printer for flyers. Before adopting a simple log, Jordan tried to piece together miles from memory and bank statements—a recipe for mistakes. Now it’s a quick habit: open the app, save the route, attach a note. Submitting takes less time than making coffee.

Or take Rina, who manages a service team across three neighborhoods. Rina used to handle complaints about “missing miles” every pay period. After setting one clear rate and standardizing the log, the inbox got quieter. As the weeks went by, the team stopped second-guessing the process. Less noise, more work done.

Wrapping it all up

California Mileage Reimbursement isn’t a niche rule—it’s a simple promise: if your car helps the company, the company covers the cost. That’s fair to the driver and smart for the business. When policies are clear, logs are easy, and payments arrive on time, everyone wins. And if you’re still wondering whether your weekly loop to client sites should be covered, ask for the policy, track your trips, and get the answer in writing. It’s your time, your car, and—when it’s for work—your reimbursement.

All in all, set clear rules, pay a fair rate, keep clean records, and keep the conversation open. That way, miles don’t turn into friction—they turn into simple, predictable entries that reflect the work already done.

Blog8 months ago

Blog8 months ago[PPT] Human Reproduction Class 12 Notes

- Blog8 months ago

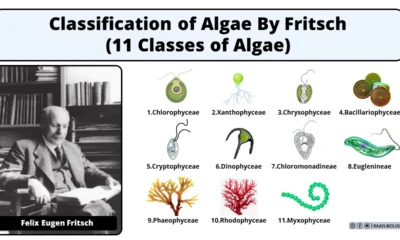

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog8 months ago

PG TRB Botany Study Material PDF Free Download

Blog8 months ago

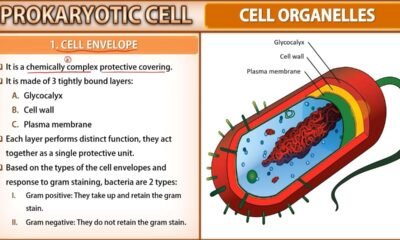

Blog8 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

Blog8 months ago

Blog8 months ago[PPT] The living world Class 11 Notes

Blog8 months ago

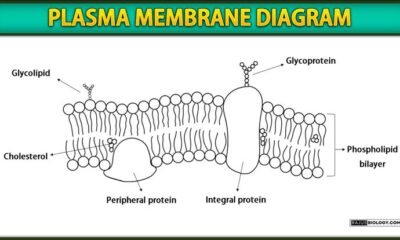

Blog8 months agoPlasma Membrane Structure and Functions | Free Biology Notes

Blog8 months ago

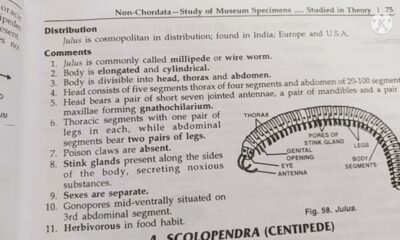

Blog8 months agoJulus General Characteristics | Free Biology Notes

Blog8 months ago

Blog8 months agoClassification of Algae By Fritsch (11 Classes of Algae)