Blog

Cashstark. com: Leads Digital Finance Innovation

The world of finance is undergoing a revolutionary change. As more users turn to digital platforms for financial management, investment tracking, and real-time trading tools, a wave of new platforms has begun to dominate the scene. One such name making noticeable strides is cashstark. com. Positioned as an innovative and user-centered platform, it offers more than just financial services. It creates a digital ecosystem where users can navigate their financial goals efficiently. The landscape of online finance is rapidly growing, and platforms that prioritize transparency, usability, and adaptability are thriving.

What Sets Cashstark. com Apart in Fintech

There are countless financial platforms on the internet, but cashstark. com stands out due to its commitment to combining technology with financial intuition. The site does not merely offer tools for budgeting or investment; it builds a learning environment for users of all experience levels. With features like AI-driven insights, predictive analytics, and real-time portfolio tracking, it brings a new standard to personal finance. Users who once relied solely on traditional banking or fragmented mobile apps are now migrating to centralized services like cashstark. com because of the holistic approach it offers.

User Experience at the Forefront

User experience remains a pillar for platforms aspiring to retain attention in a competitive digital marketplace. The design of cashstark. com is evidence of how important accessibility and ease of use are for financial services. Its clean interface allows even novice users to explore various tools with confidence. More than its design, the flow and responsiveness of its tools provide a seamless experience. Whether one is reviewing spending trends, exploring investment options, or syncing accounts, the process feels natural and intuitive. Cashstark. com knows that trust and ease-of-use are non-negotiables in fintech.

Educational Resources and Empowerment

A remarkable aspect of cashstark. com is its robust educational content. Finance can be intimidating, especially for newcomers trying to understand concepts like asset allocation, compound interest, or cryptocurrency. This platform incorporates blog posts, tutorials, live webinars, and Q&A forums, helping users expand their knowledge base. Empowering users through information is a strategy that enhances engagement and builds loyalty. It reflects an understanding that educated users are more confident in decision-making and more likely to advocate for the platform. The educational direction of cashstark. com is aligned with modern consumer needs.

Data Security and Privacy Commitment

Security remains one of the most critical concerns for online financial platforms. With the rise of digital transactions and storage of sensitive financial data, platforms must uphold stringent measures. Cashstark. com has implemented end-to-end encryption, two-factor authentication, and real-time monitoring to ensure user safety. Their transparency in communicating privacy policies and updates also builds trust. While flashy features attract users, what retains them is the assurance that their information is secure. Cashstark. com continues to meet and exceed industry standards in digital security.

Adaptability to Market Changes

Financial markets are fluid and ever-changing. For users engaged in investment or budget planning, platforms need to be as dynamic as the environment they operate in. Cashstark. com stays ahead through its integration of market news feeds, alert systems, and AI-generated insights tailored to user behavior. These tools empower users to make proactive decisions. The platform’s adaptability is seen not only in technology but also in how it listens to user feedback, releasing timely updates and new features that reflect current trends. Cashstark. com is built to evolve, a trait necessary in modern fintech.

Mobile Optimization and Accessibility

The shift to mobile-first usage has impacted every digital sector, especially finance. Users now expect the same experience on their mobile devices as on desktops. Cashstark. com has effectively optimized its platform for mobile access, ensuring that responsiveness and functionality are consistent across devices. Whether tracking transactions on the go, attending a webinar, or adjusting a portfolio, users can rely on the same performance standards. Accessibility isn’t limited to devices; cashstark. com also ensures inclusive features for users with visual or motor impairments, showcasing a broader commitment to usability.

Community Engagement and User Support

One of the distinguishing features of a great financial platform is its customer support and community engagement. Cashstark. com goes beyond chatbots and FAQ pages. It hosts live forums, moderated groups, and feedback forms that are actually acted upon. This sense of involvement cultivates a community where users feel heard and valued. Many users report that support staff are responsive, informed, and available through multiple channels. The user-centric culture of cashstark. com is not a marketing phrase but a lived experience for those engaging with the platform daily.

Comparative Advantage in the Fintech Space

When analyzing the broader fintech environment, platforms must establish clear differentiators. Cashstark. com does this by offering real-time syncing with multiple financial institutions, advanced analytics, and machine learning algorithms that enhance user predictions. While competitors may offer partial solutions, this platform bundles tools into a cohesive experience. It’s not just about managing money; it’s about understanding it. Cashstark. com does not treat finance as a mere utility but as a service that requires depth, foresight, and user alignment. This strategy helps carve its niche effectively.

Innovative Features in Development

The future of cashstark. com is promising, with several innovative features currently in the development pipeline. Plans include personalized financial coaching via AI avatars, integrations with external finance tools like tax preparation apps, and gamification to encourage financial habits. These tools aren’t gimmicks—they are the result of observing user behavior and refining the experience accordingly. Innovation is central to the platform’s growth strategy. While most platforms maintain a static list of features, cashstark. com is in a state of continuous evolution. Its roadmap indicates long-term thinking and relevance.

Strategic Partnerships and Collaborations

Strategic partnerships can greatly enhance a platform’s offerings and credibility. Cashstark. com has established ties with banking institutions, academic researchers, and fintech accelerators. These collaborations bring not just exposure, but also opportunities to innovate and expand services. For example, academic partnerships contribute to advanced financial modeling tools, while bank integrations improve user transaction speeds. The company is also exploring blockchain-based transparency tools through industry consortia. These partnerships not only strengthen the platform’s infrastructure but also validate its vision on a larger stage.

Global Expansion and Localization Strategy

Though initially developed with a regional focus, cashstark. com is eyeing global markets. International expansion requires more than language translation; it demands an understanding of regional banking laws, currencies, and consumer behavior. The platform has started building localized versions tailored to specific countries, including multi-currency support and regulatory compliance. This expansion is a signal of its ambition to become a global player. Cashstark. com realizes that financial needs vary worldwide, and a one-size-fits-all model is not sustainable in long-term growth.

Personalization and Machine Learning Integration

One of the most appreciated features of modern digital services is personalization. Cashstark. com utilizes machine learning to analyze user habits and deliver tailored experiences. From suggested saving plans to investment opportunities, every user receives recommendations grounded in their history and preferences. This makes the platform feel like a financial advisor rather than just a tool. Over time, as the system learns more about the user, its recommendations become sharper and more effective. This kind of responsive design increases retention and user satisfaction significantly.

Navigating Challenges and Competitive Pressures

The fintech space is fiercely competitive, with major players constantly improving and new startups entering with aggressive pricing or flashy interfaces. Cashstark. com is not immune to these pressures, but its commitment to meaningful innovation gives it a strategic edge. Rather than react to every trend, it focuses on sustainable features and long-term value. The platform’s resilience in the face of economic volatility, privacy concerns, and tech regulation has proven its maturity. These challenges have helped refine its roadmap rather than hinder it.

The Role of Customer Feedback in Growth

The feedback loop between users and developers is a key factor in sustainable success. Cashstark. com leverages this by maintaining regular user surveys, beta feature rollouts, and open forums where suggestions are welcomed. Many of the current popular features originated from user requests. This approach gives users a sense of ownership and deepens their loyalty. Moreover, the transparent implementation of feedback-driven changes proves the platform’s dedication to being more than just a service—it aims to be a trusted partner in its users’ financial lives.

Future-Proofing with Scalable Architecture

Scalability is a behind-the-scenes hero in fintech. A platform may succeed with a few thousand users, but can it handle millions while maintaining performance and speed? Cashstark. com was built with a modular and scalable backend infrastructure, ensuring future growth won’t compromise current quality. By investing in cloud-based architecture, redundant data protection, and streamlined databases, the team ensures that future updates and user spikes will not lead to downtime or lag. Scalability makes the platform future-proof in a highly dynamic environment.

The Role of Social Responsibility

Beyond profitability and features, platforms are increasingly judged on their ethical footprint. Cashstark. com has taken steps to promote financial literacy in underserved communities and support green technology startups. Through its foundation arm, it has launched grant programs and mentorship networks for youth interested in finance. This social responsibility aspect not only helps brand reputation but also aligns with a broader vision of equitable financial access. It reflects the understanding that long-term success involves social accountability.

Conclusion: Why Cashstark. com Matters Today

In the crowded digital finance space, relevance and trust are earned through consistency, innovation, and responsiveness. Cashstark. com has positioned itself not just as a tool for financial management but as a catalyst for financial transformation. Its integrated services, thoughtful user experience, and commitment to continuous improvement make it a compelling choice for anyone looking to enhance their financial life. As technology continues to disrupt traditional banking, platforms like cashstark. com will lead the charge into a more informed and empowered future.

Blog6 months ago

Blog6 months ago[PPT] Human Reproduction Class 12 Notes

Blog6 months ago

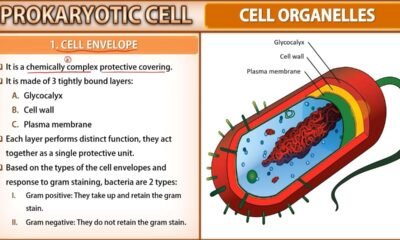

Blog6 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

- Blog6 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog6 months ago

PG TRB Botany Study Material PDF Free Download

Blog6 months ago

Blog6 months ago[PPT] The living world Class 11 Notes

Blog6 months ago

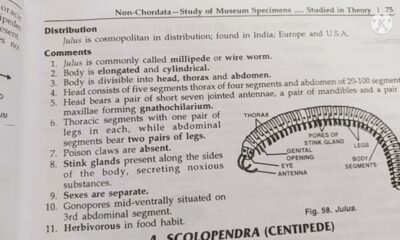

Blog6 months agoJulus General Characteristics | Free Biology Notes

Blog6 months ago

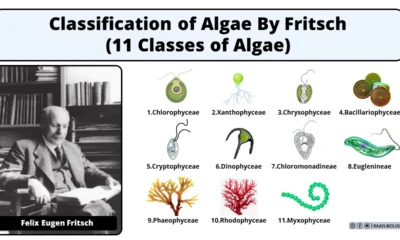

Blog6 months agoClassification of Algae By Fritsch (11 Classes of Algae)

Entertainment6 months ago

Entertainment6 months agoIbomma Bappam: Redefines Telugu Streaming Trend