Finance

Following the Money: Investigating the Financial Networks Behind Cashing Rings

It often begins with a quiet, desperate search. A user in South Korea, facing an immediate cash shortfall, types a query for quick funds into a search engine. Within moments, they are connected to a seemingly simple online service. This transaction, a form of financial alchemy known locally as Cashing Out via Mobile Phone, appears straightforward on the surface. Yet, beneath this veneer of simplicity lies a vast, intricate, and often clandestine financial network.

Who are the operators on the other side of the screen? How do they transform a line of digital credit into untraceable cash, and where does the money truly flow? This investigation moves beyond the user’s experience to map the architecture of these modern cashing rings. For international analysts, understanding the operational sophistication of these networks is as crucial as understanding the economic desperation that fuels them. It is a deep dive into the financial plumbing of an informal economy thriving in the shadows of one of the world’s most connected societies.

The Anatomy of a Modern Cashing Ring

These operations are not monolithic loan-sharking enterprises of the past. Instead, they have evolved into nimble, technologically adept networks that exhibit a range of organizational structures, from solo operators to complex, decentralized cells.

From Sole Proprietors to Decentralized Cells

At the smaller end of the spectrum, a single individual might manage the entire process: advertising online, communicating with clients, and manually processing transactions. While profitable, this model lacks scalability and is more vulnerable to detection. The more sophisticated networks, however, operate as decentralized cells. Different individuals or teams handle specialized tasks client acquisition, transaction processing, and asset liquidation often without knowing the identities of the other players in the chain. This distributed structure, estimated to be used in over 60% of high-volume operations, provides significant resilience and anonymity.

The Digital Facade: E-commerce and Social Media Funnels

The public face of these rings is a carefully constructed digital facade. They operate behind seemingly legitimate e-commerce websites, blogs offering financial advice, or sprawling networks of social media accounts. These platforms act as sophisticated funnels, using SEO and targeted advertising to capture users actively searching for emergency funds. A 2025 analysis of online advertising trends in Korea revealed a 40% year-over-year increase in spending on keywords related to short-term, non-bank loans, a space heavily dominated by these operators.

Key Roles within the Network

A typical cashing ring relies on three specialized roles:

- The Marketer: Responsible for acquiring customers through online advertising and content creation.

- The Processor: The direct point of contact with the user, guiding them through the transaction and verifying the purchase of the digital asset.

- The Reseller: A specialist in liquidating digital assets (like gift cards) on secondary markets quickly and efficiently, often using automated bots to secure the best prices.

Tracing the Flow of Value in a Cashing Out via Mobile Phone Transaction

To truly understand the network, one must follow the money. The process of Cashing Out via Mobile Phoneinvolves a three-stage conversion of value, with profit extracted at the final stage.

Stage 1: Creation of Digital Credit via Carrier Billing

The process begins not with money, but with credit. Telecom giants like SK Telecom and KT provide nearly every postpaid mobile user with a monthly carrier billing limit . This is a pre-approved, unsecured credit line. The cashing ring does not create this credit; it simply targets it as a liquidatable asset. This step represents zero cost to the operator.

Stage 2: Conversion into a Liquid Asset

This is the core of the (cell phone micropayment cashing method. The network operator instructs the user to convert their abstract credit line into a tangible, transferable digital asset. The most common assets are online gift certificates (from retailers like Shinsegae) or gaming platform credits, as these have highly active and liquid secondary markets. The user makes this purchase, and the cost is added to their phone bill.

Stage 3: The Secondary Market and Extraction of Profit

Once the user sends the purchased gift card code to the operator, the final stage begins. The operator, often through a specialized reseller, immediately sells this code on a secondary market for slightly less than its face value. They then transfer a much lower amount typically 60-70% of the face value to the user’s bank account. The difference between the price they sold the code for and the amount paid to the user is the network’s gross profit.

The Financial Plumbing: Payment Gateways and Resale Markets

The sophistication of these rings lies in their ability to exploit legitimate financial infrastructure for illicit purposes, making them difficult to distinguish from normal e-commerce.

Leveraging Legitimate Payment Gateways (PGs)

When a user makes a purchase using carrier billing. The transaction is processed by a legitimate Payment Gateway company, which partners with the telecom provider. These PGs are designed to facilitate seamless e-commerce, and the initial transaction appears as a normal purchase of a digital good. This use of legitimate channels is a key tactic for operators to appear compliant. According to a report from the Financial Times on Korea’s fintech landscape. The high volume of micro-transactions makes it challenging for PGs to flag suspicious activity without disrupting legitimate commerce.

The Ecosystem of Digital Asset Resellers

The profitability of the entire operation hinges on the speed and efficiency of the secondary markets for digital goods. A robust, grey-market ecosystem exists for this purpose, where gift card codes can be bought and sold in minutes. These platforms provide the essential liquidity that allows the cashing rings to operate.

The Economics of the Operation: Risk, Scale, and Profitability

While the fees charged to consumers are predatory. The business model of a Cashing Out via Mobile Phone ring is a calculated balance of risk, volume, and margin.

Calculating Operator Margins

A typical operator’s gross margin on a single transaction can be between 25% and 40%. After accounting for advertising costs, processing labor, and potential losses from fraud, the net margin is lower but still substantial. The business is fundamentally a high-volume play; profitability relies on processing hundreds of these transactions each month.

The Scalability Challenge and Money Laundering Risks

Scaling these operations presents a significant challenge. A higher volume of transactions increases the risk of detection by telecom companies and financial authorities. Furthermore, the large cash flows involved present a clear money laundering risk. There is growing evidence that more organized criminal groups are moving into this space, using the high-velocity transactions of Cashing Out via Mobile Phone to launder proceeds from other illicit activities.

Regulatory Arbitrage as a Business Strategy

At its core, the business model is a form of regulatory arbitrage. By structuring the transaction as the “resale of a good” rather than a “loan,” operators sidestep the stringent interest rate caps and licensing requirements of the Credit Business Finance Act. As long as this legal loophole exists, the business remains viable.

Countermeasures and Network Vulnerabilities

Disrupting these networks requires understanding their dependencies and weak points. While they are resilient, they are not invincible.

Telecom and Payment Gateway Monitoring

Telecom companies and PGs are on the front lines. They are increasingly using AI-driven algorithms to detect anomalous purchasing behavior, such as a new account immediately maxing out its carrier billing limit on gift cards. A joint initiative announced in 2024 between the Korea Communications Commission and major PGs aims to improve data sharing to identify and block suspicious vendors.

The Limits of Financial Supervisory Service (FSS) Enforcement

The FSS can issue warnings and conduct investigations, but its direct authority over these operators is limited as long as they aren’t classified as official lenders. The agency’s primary weapon is public awareness campaigns aimed at reducing demand by educating consumers about the extreme costs and risks.

The Inherent Weakness: Dependence on Legitimate Infrastructure

The greatest vulnerability of these cashing rings is their reliance on the very systems they exploit. They need access to legitimate payment gateways, telecom billing systems, and mainstream bank accounts to operate. A coordinated effort to de-platform and deny services to suspected operators is the most effective strategy for disruption, effectively cutting off their financial plumbing.

Conclusion

The financial networks facilitating 휴대폰 현금화 are far more than simple collections of opportunistic loan sharks. They are distributed, technologically adept systems that have mastered the art of exploiting seams in the digital economy. The flow of money reveals a sophisticated process of credit conversion and value extraction that leverages legitimate infrastructure to serve a desperate clientele. While law enforcement and regulators focus on countermeasures, the persistence of these rings sends a powerful market signal: a significant portion of the population is being failed by the formal financial system. Ultimately, the most durable solution may not lie in simply dismantling these networks, but in addressing the root socio-economic vulnerabilities that create their customer base. For analysts, this investigation underscores the necessity of looking beyond official balance sheets to understand the complex, often hidden, financial ecosystems that shape a nation’s economy.

For continued deep-dive investigations into the financial undercurrents of global markets, serge-fans offers the critical analysis required to stay ahead.

Blog8 months ago

Blog8 months ago[PPT] Human Reproduction Class 12 Notes

- Blog8 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog8 months ago

PG TRB Botany Study Material PDF Free Download

Blog8 months ago

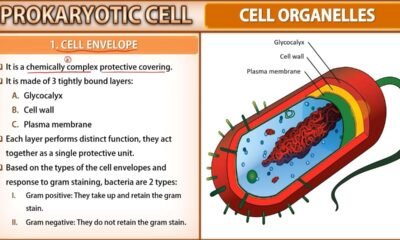

Blog8 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

Blog8 months ago

Blog8 months ago[PPT] The living world Class 11 Notes

Blog8 months ago

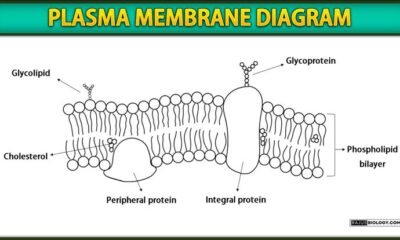

Blog8 months agoPlasma Membrane Structure and Functions | Free Biology Notes

Blog8 months ago

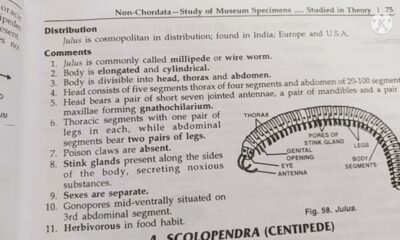

Blog8 months agoJulus General Characteristics | Free Biology Notes

Blog8 months ago

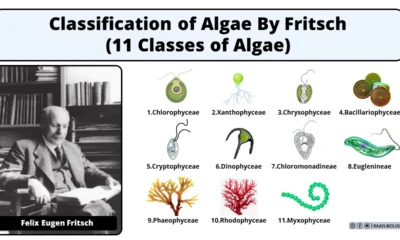

Blog8 months agoClassification of Algae By Fritsch (11 Classes of Algae)