Business

tmb net banking: Features and User Benefits

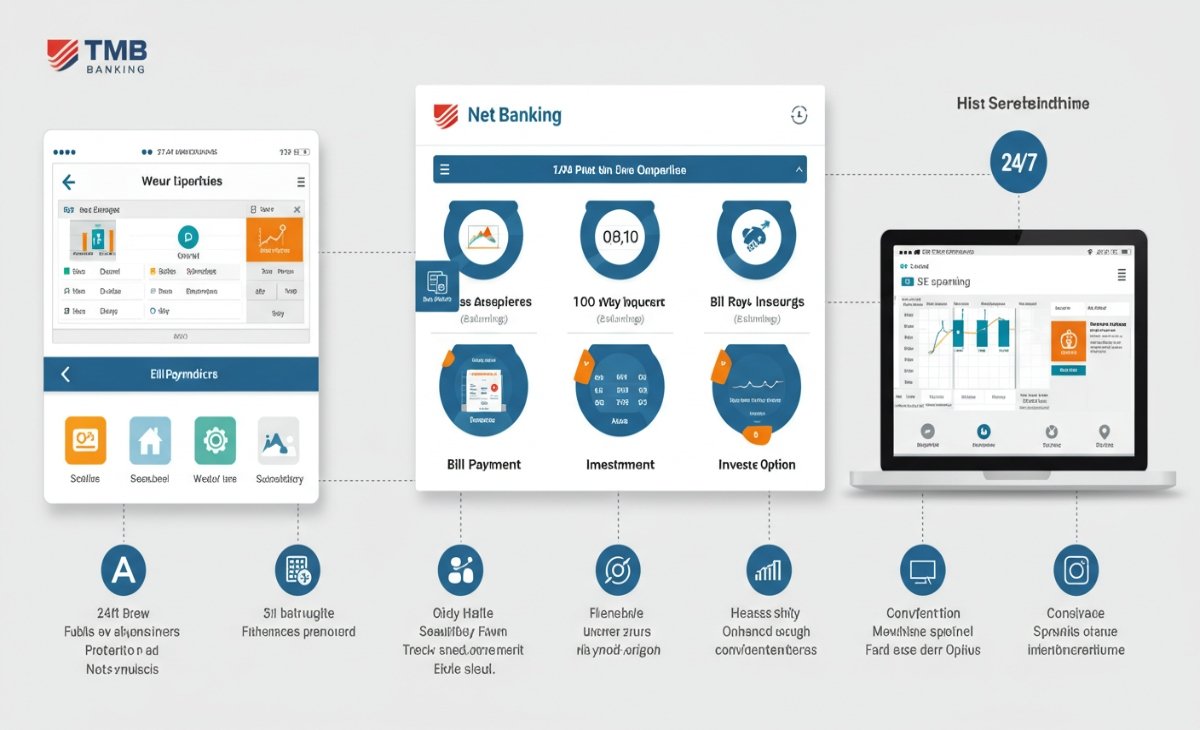

In today’s digital world, banking has transformed from a manual, time-consuming process to a convenient, real-time service accessible at your fingertips. One of the prime examples of this evolution is tmb net banking. Offered by Tamilnad Mercantile Bank, this service enables customers to manage their finances online without the need to visit a branch. The introduction of this online platform has significantly improved banking efficiency and customer satisfaction by providing secure, fast, and user-friendly banking tools.

The History and Growth of Tamilnad Mercantile Bank

Tamilnad Mercantile Bank, commonly referred to as TMB, has a rich history dating back to 1921. The bank has always focused on customer-centric services and has adapted well to changes in the financial sector. With the advancement in digital technologies, TMB introduced tmb net banking as a part of its initiative to modernize banking operations and reach a wider customer base. Over the years, this service has expanded to include a broad range of features, from simple fund transfers to advanced financial management tools.

You Might Also Like: Ecryptobit.com Wallets

How to Register for tmb net banking

Registration for tmb net banking is straightforward and designed to be user-friendly. Customers can begin the registration process by visiting the official TMB website and navigating to the net banking section. Here, users can apply for net banking by providing essential information like their account number, registered mobile number, and customer ID. Once verification is completed, they receive a unique user ID and password, which they can use to log in securely. TMB also provides step-by-step assistance for those facing issues during registration.

Login Process and User Interface

After successful registration, logging in to tmb net banking is simple. Users need to visit the bank’s net banking portal and enter their credentials. The user interface is designed to be intuitive, with clear sections for different banking functions. Upon login, customers can view account summaries, check balances, download statements, and initiate transactions. The portal’s layout ensures smooth navigation, even for first-time users. Accessibility features and multi-language support also enhance the user experience across diverse customer segments.

Fund Transfer and Payment Options

One of the most utilized features of tmb net banking is the ability to perform fund transfers quickly and securely. The platform supports several methods including NEFT, RTGS, and IMPS, allowing users to transfer money to other TMB accounts or to accounts in other banks. Users can also set up recurring transfers or schedule future payments, making financial planning more efficient. Additionally, customers can pay utility bills, recharge mobile phones, and pay credit card bills directly through the net banking interface.

Checking Account Balance and Transaction History

With tmb net banking, checking your account balance no longer requires a visit to the bank or an ATM. Users can view their current balance and mini statements in real-time. The platform also allows access to full account statements for a selected date range, which can be downloaded in various formats for personal record-keeping or official use. This function is particularly beneficial for business owners and salaried professionals who need accurate transaction records.

Fixed Deposits and Recurring Deposits Management

Managing fixed deposits (FDs) and recurring deposits (RDs) becomes seamless with tmb net banking. Customers can open new FDs or RDs, renew existing ones, and even break them prematurely if needed, all from the comfort of their homes. The platform also provides interest rate calculators and maturity value estimators to help users plan their savings more effectively. Account holders can monitor the performance of their deposits and receive timely reminders for renewals.

Loan Account Management via tmb net banking

Loan customers benefit from tmb net banking by gaining access to detailed loan account statements and EMI schedules. The portal enables users to make EMI payments, check outstanding loan balances, and download interest certificates for tax purposes. It simplifies communication between the bank and borrower, enabling quick resolution of loan-related queries without the need for physical visits to the branch.

Security Features Ensuring Safe Banking

Security is a cornerstone of tmb net banking. The bank employs multiple layers of security, including two-factor authentication, transaction passwords, OTPs, and CAPTCHA codes, to protect user information and prevent fraud. TMB also conducts regular system audits and uses encryption technologies to ensure that all data transferred through its net banking service remains secure. Customers are encouraged to update passwords frequently and avoid sharing login details to maintain account safety.

Mobile Compatibility and Access on the Go

In response to the increasing use of smartphones, tmb net banking is optimized for mobile browsers. Although the bank also offers a dedicated mobile banking app, customers can access the net banking platform directly through their mobile browser. This feature ensures that essential banking functions are never out of reach, whether the user is traveling, at work, or home. The mobile version retains all core features and ensures a responsive, seamless experience.

TMB E-Statement and Document Access

Customers who need official documentation of their account activity can rely on the E-Statement feature of tmb net banking. These statements are digitally signed and can be used for tax filing, visa applications, or audit purposes. The platform allows monthly, quarterly, or custom period statements to be downloaded in PDF or Excel formats. Additionally, users can view interest summaries, TDS details, and investment documentation, providing a centralized hub for all financial paperwork.

Custom Alerts and Notifications

With tmb net banking, users can set up customized alerts to monitor account activity. Alerts can be configured for low balances, large transactions, cheque clearances, and payment due dates. Notifications are delivered via email or SMS, helping customers stay updated and in control of their finances. These proactive features not only improve awareness but also reduce the likelihood of missed payments or unauthorized transactions.

Customer Support and Technical Assistance

TMB offers extensive customer support for tmb net banking users. From toll-free helplines to dedicated email support and FAQs, the bank ensures that users receive assistance whenever needed. In case of forgotten passwords, login issues, or transaction failures, customers can easily raise service requests through the portal itself. The bank also conducts periodic workshops and provides video tutorials to help customers become familiar with the platform’s features.

Transaction Limits and Control Settings

tmb net banking offers flexibility by allowing users to set transaction limits according to their needs. Daily limits can be modified based on account type, security settings, and user preferences. This feature provides greater control and enhances security by minimizing exposure to unauthorized or fraudulent transactions. Businesses, in particular, benefit from this function as they can manage multiple employee access levels and restrict certain operations.

Benefits for Businesses and Corporates

Small businesses and large enterprises alike benefit significantly from tmb net banking. The platform allows bulk transactions, payroll processing, tax payments, and vendor settlements. With multi-user access and customizable roles, corporate users can manage finances more efficiently and securely. Businesses can also access real-time analytics and detailed reports that assist in financial decision-making and compliance management.

Digital Services Beyond Basic Banking

TMB has expanded its online offerings beyond traditional banking. Users can apply for insurance, open demat accounts, invest in mutual funds, and purchase government bonds directly through tmb net banking. This diversification allows customers to manage a wide range of financial products from a single platform. As part of its mission to provide a full-service digital bank, TMB continues to integrate additional financial tools into its net banking ecosystem.

Common Issues and Troubleshooting Tips

Despite the advantages, users may occasionally face challenges with tmb net banking such as login errors, delayed OTPs, or session timeouts. To address these, TMB provides easy-to-follow troubleshooting guides and responsive customer service. Regular browser updates, clearing cookies, and avoiding public Wi-Fi can significantly reduce technical issues. Staying informed about maintenance schedules also helps users plan their banking activities more effectively.

Future Enhancements and Innovation Plans

Tamilnad Mercantile Bank continuously works on enhancing its digital offerings. Future plans for tmb net banking include AI-driven financial insights, voice-assisted navigation, and integration with smart home devices. The bank is also exploring blockchain for improved security and faster settlements. These innovations will make the platform even more robust, allowing TMB to stay ahead in the competitive digital banking space.

The Importance of Digital Literacy for Users

As tmb net banking becomes a cornerstone of modern banking, it is essential that users develop a basic understanding of digital finance. TMB regularly promotes awareness programs aimed at educating users on cyber safety, phishing threats, and best practices for secure transactions. Empowered customers are less likely to fall prey to fraud and more likely to enjoy the full benefits of online banking.

Conclusion: Embracing Convenience Through tmb net banking

tmb net banking represents a significant leap forward in how customers interact with their bank. It combines security, speed, and simplicity, making everyday banking tasks more manageable and accessible. Whether you’re a student managing your first savings account or a business owner overseeing complex financial operations, tmb net banking caters to a broad spectrum of needs. As digital banking continues to evolve, TMB’s commitment to innovation ensures that its customers stay ahead in managing their financial future.

Blog6 months ago

Blog6 months ago[PPT] Human Reproduction Class 12 Notes

Blog6 months ago

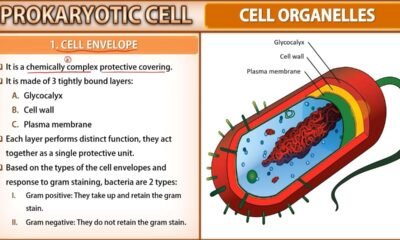

Blog6 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

- Blog6 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog6 months ago

PG TRB Botany Study Material PDF Free Download

Blog6 months ago

Blog6 months ago[PPT] The living world Class 11 Notes

Blog6 months ago

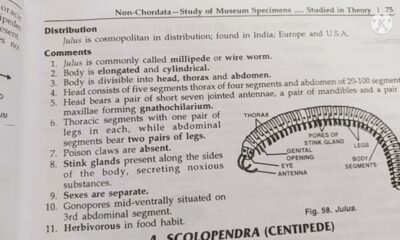

Blog6 months agoJulus General Characteristics | Free Biology Notes

Blog6 months ago

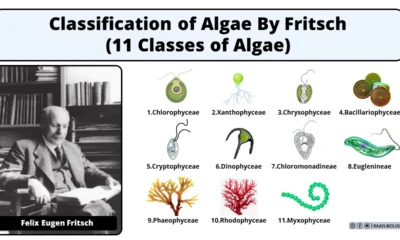

Blog6 months agoClassification of Algae By Fritsch (11 Classes of Algae)

Entertainment6 months ago

Entertainment6 months agoIbomma Bappam: Redefines Telugu Streaming Trend