Finance

Traceloans.com Student Loans: Simplify Debt Tracking

Managing student loans can be one of the most confusing financial responsibilities for many individuals. Whether still in school or years into repayment, understanding loan balances, interest accrual, and payment schedules can often become overwhelming. To help borrowers better navigate this complexity, platforms like traceloans.com student loans have emerged with smart tools, detailed dashboards, and real-time assistance designed to simplify the entire experience.

Traceloans.com student loans is a digital solution aimed at tracking and managing student loan debt from multiple servicers in one place. It helps users organize their loan data, visualize repayment progress, and access repayment or forgiveness options based on real-time information. For those who may feel lost juggling federal and private loans, this platform offers clarity and direction.

The education loan landscape has evolved rapidly over the last decade. Interest rates change, forgiveness programs expand, and servicers rotate regularly. In such an unpredictable environment, having a tool that keeps borrowers informed and in control becomes a necessity rather than a luxury. Traceloans.com student loans offers precisely that by giving users a full snapshot of their loan obligations while offering intelligent recommendations.

How Traceloans.com Student Loans Works

Traceloans.com student loans starts with user registration. Once signed up, borrowers can link their loan accounts or manually enter loan details such as outstanding balances, loan types, interest rates, servicer names, and monthly due dates. The system then aggregates this information into a unified dashboard.

This dashboard is the heart of the platform. It offers a clear, up-to-date display of total debt, interest projections, payment history, and upcoming obligations. Users can see how much they’ve paid, how much interest they’ve accumulated, and what remains until full repayment. The layout is designed for simplicity, helping even financially inexperienced users understand their situation at a glance.

You Might Also Like: Ecryptobit.com Wallets

Unlike some government sites that may be hard to navigate, traceloans.com student loans offers intuitive design and interactive charts. This empowers users to explore various scenarios and repayment options using tools built directly into the interface. These include comparisons between different repayment plans, early payment simulations, and interest optimization strategies.

Benefits of Using Traceloans.com Student Loans

Traceloans.com student loans provides multiple advantages over traditional tracking methods. First and foremost is the convenience of having all loan data consolidated in one place. Many borrowers manage multiple loans across federal and private lenders, making it difficult to track due dates and interest growth. This platform eliminates the need to jump between multiple sites or spreadsheets.

Another key benefit is transparency. The interface makes it easier to see how much interest accrues daily, how much of a monthly payment goes to principal versus interest, and how additional payments can reduce the loan term. This level of detail helps users make more informed decisions and avoid surprises.

The site also offers proactive notifications. Users receive reminders for upcoming payments, potential payment shortfalls, or changes to interest rates. These alerts help prevent missed payments and support better financial planning. Additionally, the platform allows users to set repayment goals, which it then tracks with visual progress bars and milestone achievements.

Understanding Repayment Options

Repayment is often the most daunting part of student loan management. Traceloans.com student loans demystifies the repayment landscape by breaking down each available option with comparisons based on the user’s actual loan data. These include the standard 10-year plan, graduated repayment, extended repayment, and income-driven plans like REPAYE and IBR.

Each repayment plan is explained in clear terms. Users can explore how switching plans would affect their monthly payments, interest paid over time, and overall loan term. The platform uses real-time calculations to show the financial impact of each choice.

For those with federal loans, the platform also tracks forgiveness eligibility, including PSLF and income-driven plan forgiveness. It keeps a count of qualifying payments and prompts users to submit necessary forms on time. This helps ensure borrowers don’t miss opportunities due to administrative oversights.

Managing Private Loans on Traceloans.com

While federal loans receive much attention, many borrowers also carry private student debt. Traceloans.com student loans supports these accounts by offering tools that help users track repayment terms, lender-specific interest rates, and refinancing opportunities.

Private loans don’t qualify for income-driven plans or forgiveness, so managing them efficiently is crucial. The platform provides refinancing calculators, lender comparisons, and tips on consolidating loans without losing benefits. It also highlights when it might be advantageous to pay off private loans first based on interest accrual and term length.

Users can evaluate the benefits of variable versus fixed interest rates, and determine when refinancing might reduce the total cost. Traceloans.com gives borrowers a full picture so that decisions are based on strategy, not guesswork.

Refinancing Tools and Cost Analysis

One standout feature of traceloans.com student loans is its refinancing tool. Borrowers can simulate refinancing scenarios by adjusting interest rates, loan terms, and origination fees. The system instantly shows the new monthly payment, the total amount saved, and the break-even point for any refinancing decision.

This level of interactivity helps users determine whether refinancing is worth pursuing, especially if they have strong credit or a cosigner. The tool avoids marketing bias by providing data without pushing one lender over another. This allows users to shop intelligently while protecting their financial future.

The platform also tracks when fixed rates are trending downward and notifies users when they may be in a good position to refinance. By staying ahead of market shifts, borrowers can take action at the right time to save money.

Forgiveness and Deferment Eligibility

With ever-changing rules around forgiveness, deferment, and forbearance, staying informed is vital. Traceloans.com student loans tracks current forgiveness programs and alerts users when new waivers, emergency policies, or deadlines emerge.

Whether it’s PSLF adjustments or new income-driven repayment updates, the platform keeps users informed with notifications and articles. It helps users track employment verification, file paperwork correctly, and avoid missing qualifying payments due to technical errors.

For those who face hardship, the platform explains deferment and forbearance options. It outlines what these mean for interest accrual, credit reporting, and future repayment plans. This helps borrowers make decisions that balance short-term relief with long-term cost.

Security and Data Privacy

Privacy is a top concern when it comes to financial data. Traceloans.com student loans uses industry-standard encryption and two-factor authentication to protect user accounts. Data is not shared with third parties unless explicitly authorized by the user.

The platform ensures that read-only access is granted when linking loan accounts, preventing any unauthorized changes. Users can also manually input data if they prefer not to sync accounts digitally. This flexible approach gives users control over how their information is stored and used.

Regular audits and compliance with data protection laws ensure that user data remains secure. These practices build confidence among users who depend on the platform for their financial planning.

Accessibility and Mobile Experience

Traceloans.com student loans is built to be mobile-responsive, allowing users to access their dashboard from phones or tablets. This flexibility supports on-the-go financial management. Whether commuting, traveling, or attending classes, users can check balances, make adjustments, or receive alerts without needing a computer.

The design is clean, fast, and user-focused. It avoids clutter and prioritizes clarity, making it ideal for users of all ages and tech backgrounds. Whether checking balances or running simulations, every function is a tap or swipe away.

Customer Support and Educational Content

Beyond tools and trackers, traceloans.com student loans provides customer support through email and live chat. The support team helps resolve technical issues, clarify loan terms, and explain complex repayment options.

The site also offers a resource library. This includes FAQs, glossary terms, webinars, and blog posts on financial literacy topics. From understanding compound interest to navigating student loan tax benefits, the content is designed to educate and empower.

The goal is not just to manage loans but to build long-term financial skills. Borrowers are encouraged to understand how debt fits into their overall financial life, not just focus on monthly payments.

Who Benefits Most from Traceloans.com

Traceloans.com student loans is suitable for a wide range of borrowers. Recent graduates can use it to create their first repayment plan. Mid-career professionals can monitor progress and evaluate refinancing. Parents with PLUS loans can stay informed about balances and payoff strategies. Even students still in school can prepare for repayment by tracking disbursements and projecting future payments.

Its flexibility and user-friendly design make it useful for anyone with student loan obligations, regardless of financial literacy level or loan complexity.

Frequently Asked Questions

What is traceloans.com student loans?

It is an online platform that helps users track, manage, and repay their student loans with personalized tools and real-time updates.

Is traceloans.com student loans free?

Basic features are free to use. Some advanced tools or partner integrations may offer optional paid enhancements.

Can I manage both federal and private loans?

Yes, the platform allows users to link or manually enter both federal and private student loans into a unified dashboard.

Does the site support forgiveness tracking?

Yes, it helps users monitor their eligibility for forgiveness programs like PSLF and income-driven plan forgiveness.

Is it safe to link my loan accounts?

Yes, it uses secure, read-only access and encryption to protect user data and ensure privacy.

How often is my loan data updated?

Loan data is updated daily when linked to servicers, ensuring users have the most current information available.

Conclusion

Managing student loans doesn’t have to feel like an endless maze. With traceloans.com student loans, borrowers gain clarity, control, and confidence. From tracking balances to exploring repayment options, this platform is a powerful ally in navigating one of life’s most significant financial journeys.

Whether you’re just starting repayment or nearing the finish line, traceloans.com helps simplify decisions, avoid pitfalls, and make the most of available programs. In a world where debt can feel overwhelming, having a tool that guides you step by step makes all the difference.

Blog8 months ago

Blog8 months ago[PPT] Human Reproduction Class 12 Notes

- Blog8 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog8 months ago

PG TRB Botany Study Material PDF Free Download

Blog8 months ago

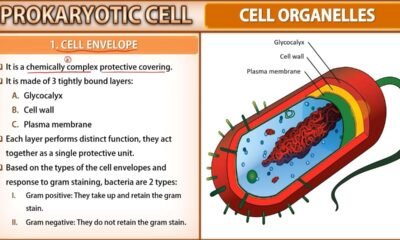

Blog8 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

Blog8 months ago

Blog8 months ago[PPT] The living world Class 11 Notes

Blog8 months ago

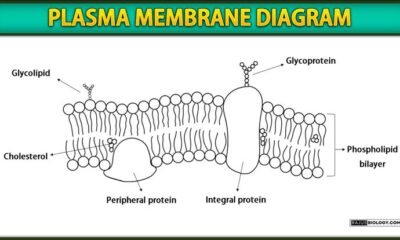

Blog8 months agoPlasma Membrane Structure and Functions | Free Biology Notes

Blog8 months ago

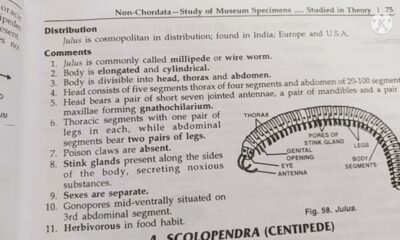

Blog8 months agoJulus General Characteristics | Free Biology Notes

Blog8 months ago

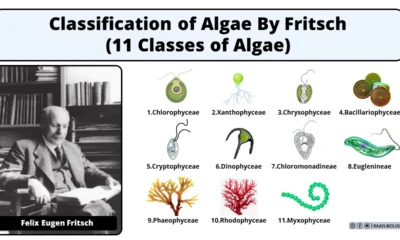

Blog8 months agoClassification of Algae By Fritsch (11 Classes of Algae)