News

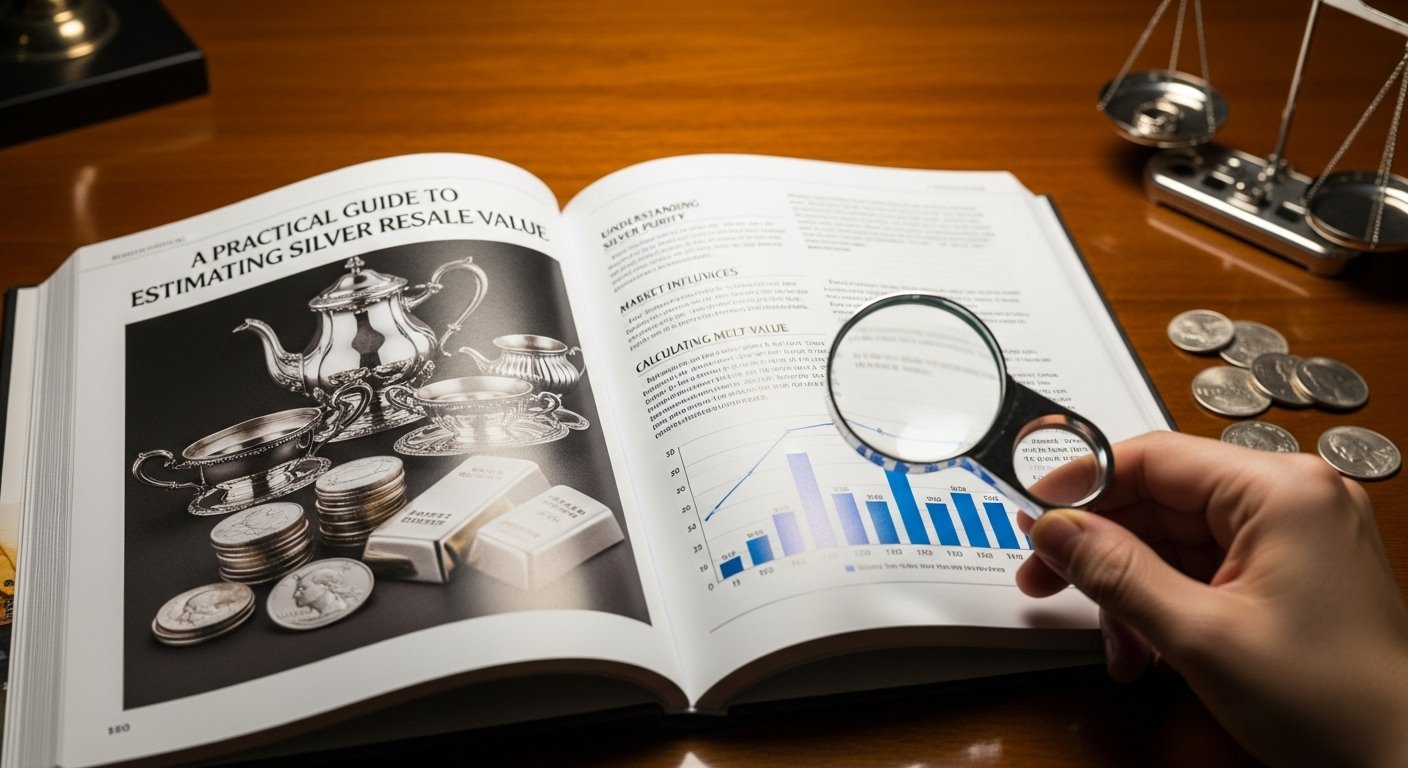

A Practical Guide to Estimating Silver Resale Value

For many people, pawning old or unwanted silverware is a quick and convenient way to get their hands on some cash. However, uninformed sellers are often surprised to find that the offer they’re given by the buyer is quite different from the market price of the precious metal being quoted in the news. Why is this? That’s what this article sets out to explain.

Here are the key factors you should consider when estimating the resale value of your silver.

Start With The Spot Price

The spot price is the per-ounce figure quoted by the media each day and often displayed on screens by brokers and precious metal dealers. However, this price is set for the trading of large quantities of investment-grade raw silver that can easily be verified. It’s not designed to be strictly followed or applied to retail transactions, which often involve small quantities, scrap silver, alloys, and items that are hard to verify.

All it is is a reference point. If the spot price is high, you can expect to receive more for your silverware than when it is low. But you won’t receive the spot price itself because other factors will be priced in by the buyer. These are listed below.

Check If You Can Prove Purity

Sterling silver, often used in jewellery, is of a lower purity than the silver used in investment products like bullion and coins. Alloys will be even less so. The lower the purity, the lower the price you can expect.

You can also expect lower prices for items that are not hallmarked or for which you do not have certificates stating the purity. Testing costs money, which buyers will subtract, and it also increases their risk.

Think About the Form

When you sell silver, coins and bars typically command the highest prices because they’re standardised and easy to store. Because they have no practical use, they also tend not to experience as much wear.

Jewellery and flatware tend to receive lower prices because it may be more difficult for the buyer to resell. They must wait for someone who likes the design. Remember that how much you like it, its sentimental value to you, and the brand are not usually of importance to silver buyers.

Consider the Condition

As with any type of product for sale, silver with defects will have its value discounted. Silverware that is bent, scratched or worn will sell for less. If the condition is especially poor, it may lead to questions about its purity and authenticity.

See It From Their Perspective

Silver buyers aren’t making a one-off transaction with you. They’re running a business and have to factor in things like overheads, wages, insurance, and hedging the risk that the silver spot price will fall after they buy from you.

You should also remember that the speed and convenience of a local pawnshop come at a price. If you’re willing to be patient and research businesses that will buy your silver, you might find a better deal.

Conclusion

By considering each of these factors in turn, you can create a more accurate estimate of your silver value. You can also apply this framework to any other precious metals and stones you plan to sell.

Blog8 months ago

Blog8 months ago[PPT] Human Reproduction Class 12 Notes

- Blog8 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog8 months ago

PG TRB Botany Study Material PDF Free Download

Blog8 months ago

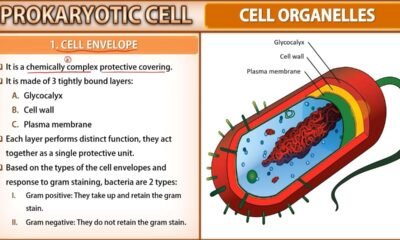

Blog8 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

Blog8 months ago

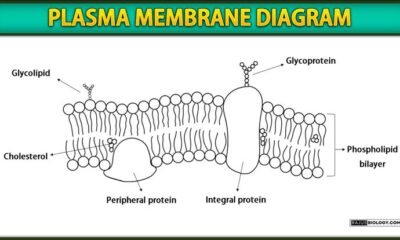

Blog8 months agoPlasma Membrane Structure and Functions | Free Biology Notes

Blog8 months ago

Blog8 months ago[PPT] The living world Class 11 Notes

Blog8 months ago

Blog8 months agoJulus General Characteristics | Free Biology Notes

Blog8 months ago

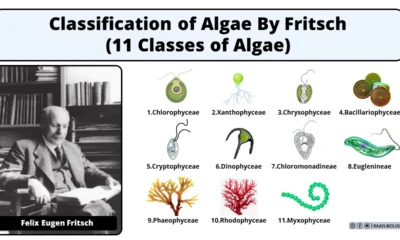

Blog8 months agoClassification of Algae By Fritsch (11 Classes of Algae)