Finance

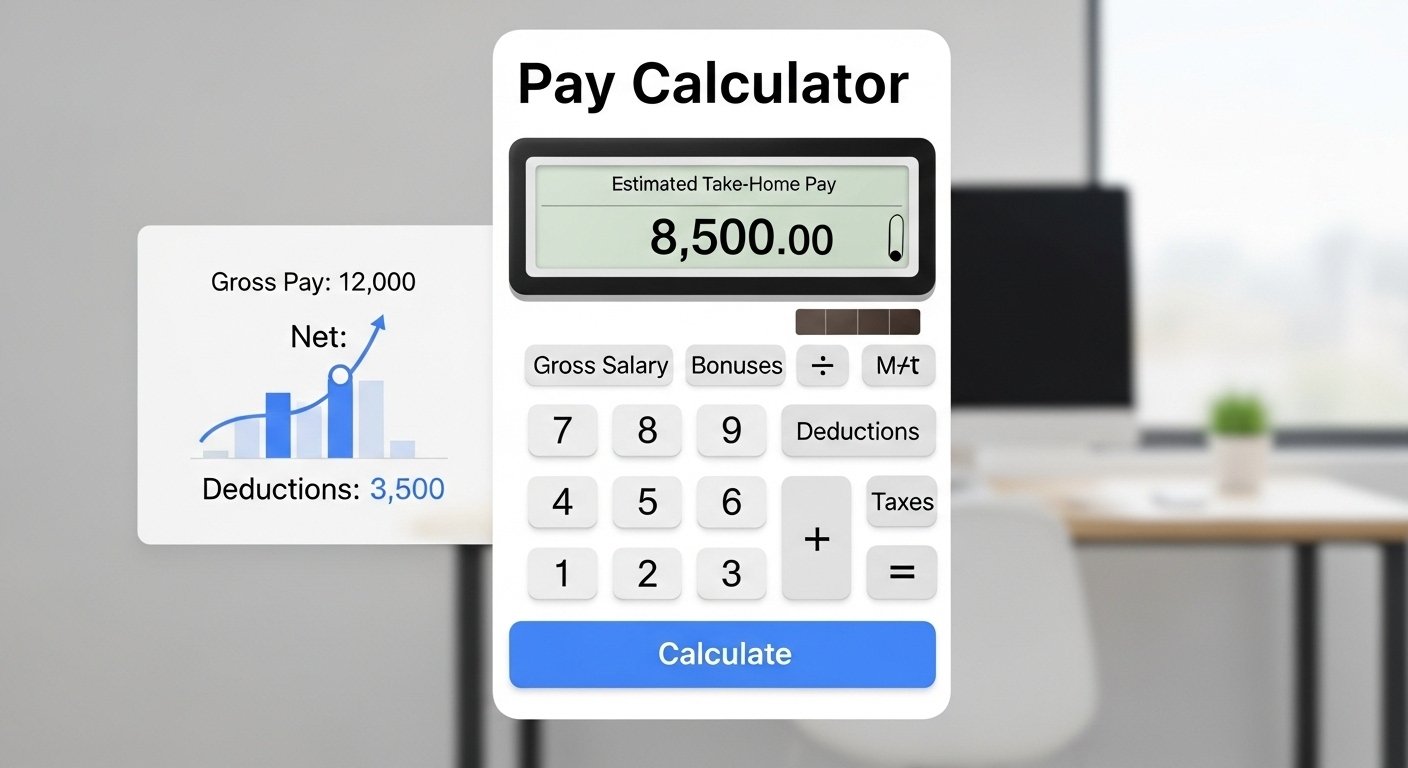

Pay-Calculator: A Complete Solution for Accurate Salary and Take-Home Pay Calculations

Understanding how much money you actually take home from your salary is more important than ever. With constantly changing tax rules, social insurance systems, and regional regulations, gross salary figures alone can be misleading. Many employees, freelancers, and job seekers struggle to clearly understand deductions, tax obligations, and real net income. Pay-Calculator, available at paycalculator.ai, is designed to solve this problem by offering an accurate, easy-to-use, and up-to-date payroll calculation platform for users around the world.

Pay-Calculator is a modern online salary calculation tool that complies with the latest tax systems and payroll rules. It instantly calculates take-home pay and presents clear explanations of taxes and social insurance deductions. Whether you are evaluating a job offer, planning your finances, or preparing for a salary negotiation, Pay-Calculator helps you see exactly where your money goes.

What Is a Pay-Calculator?

Pay-Calculator is a free, online payroll and salary calculator built to deliver precise net income results. By entering your gross salary and selecting the relevant country or region, users can instantly view deductions such as income tax, social security, and mandatory contributions. The platform transforms complex payroll calculations into simple, understandable outputs.

At its core, Pay-Calculator focuses on transparency. Instead of presenting only a final number, it breaks down each deduction so users can understand how their net pay is calculated. This clarity makes it a reliable tool for professionals who want confidence in their financial decisions.

US Salary Calculations Made Simple

The United States payroll system is known for its complexity. Federal income tax, state tax, local tax, FICA contributions, and W-4 withholding rules all affect take-home pay. Calculating net salary manually can be confusing and time-consuming. Pay-Calculator addresses this challenge with a dedicated US salary calculator that handles these calculations accurately.

The US Pay Calculator includes:

- Federal income tax calculations for the latest tax year

- State and local tax estimates

- FICA deductions, including Social Security and Medicare

- Gross-to-net salary conversion

- W-4 withholding estimation

This allows users to quickly understand their true earnings without needing tax expertise. Whether you are switching jobs, negotiating compensation, or budgeting for the year ahead, the US salary calculator offers a reliable solution.

Clear Net Pay Insights for Better Planning

One of the main reasons people turn to Pay-Calculator is to clearly understand their take-home pay. Gross salary figures often look attractive, but deductions can significantly reduce actual income. Pay-Calculator functions as a powerful net pay calculator, helping users see what they will really keep after taxes and contributions.

With the net pay calculator, users can:

- Instantly convert gross salary to net income

- Understand how much is deducted for taxes and insurance

- Compare different salary offers accurately

- Plan monthly budgets with confidence

This clarity is especially useful for employees who want to verify payslips, freelancers managing irregular income, or anyone planning long-term finances.

Global Pay Calculators for Multiple Countries

Pay-Calculator is not limited to the United States. It supports a growing range of country-specific calculators, each updated with the latest tax laws and contribution rates. These calculators ensure accurate results tailored to local payroll systems.

Japan Pay Calculator 2026

An accurate and easy-to-use payroll tool that complies with Japan’s latest tax and social insurance systems. It calculates income tax, resident tax, and social insurance deductions, helping users understand their real take-home pay.

UK Pay Calculator

Calculates net salary by factoring in Income Tax, National Insurance (NI), and student loan repayments. This tool is ideal for UK employees comparing job offers or planning monthly income.

Germany Gehaltsrechner

Designed for Germany’s payroll system, this calculator accounts for income tax, social security contributions, church tax, allowances, and all tax classes. It provides fast and precise net salary results.

France Pay Calculator

Helps users clearly distinguish between gross and net salary in France. It factors in income tax, social contributions, overtime, and potential family allowances, making it ideal for job comparisons and payslip checks.

Brazil Pay Calculator 2026

Simulates net salary in Brazil by automatically calculating INSS, IRRF (in accordance with Law No. 15,270), and FGTS under the CLT employment regime.

India Pay Calculator 2026

Converts CTC into monthly in-hand salary for FY 2026–27. Supports both new and old tax regimes, EPF deductions, and professional tax using updated tax slabs.

Korea Pay Calculator 2026

Updated with the latest contribution rates, this calculator accounts for income tax, national pension, health insurance, and the four major social insurances in South Korea.

Saudi Pay Calculator 2026

An advanced tool for Saudi Arabia that includes GOSI deductions, housing allowances, and end-of-service gratuity estimates based on 2026 labor law.

Vietnam Pay Calculator 2026

Instantly converts gross salary to net salary while covering social insurance, personal income tax, family deductions, and regional minimum wage standards.

Who Should Use a Pay-Calculator?

Pay-Calculator is designed for a wide audience:

- Employees who want to understand payslips and plan budgets

- Job seekers comparing offers across countries or regions

- Freelancers and contractors estimating real income

- HR professionals explaining salary structures

- Anyone preparing for salary negotiations or job changes

Its accuracy and simplicity make it suitable for both everyday use and important financial decisions.

Simple, Accurate, and Up to Date

Despite handling complex payroll systems, Pay-Calculator remains easy to use. The interface is clean and intuitive, allowing users to input details and get results instantly. Behind the scenes, the platform is updated regularly to reflect the latest tax laws and contribution rates, ensuring reliability and relevance.

Conclusion

In a world where payroll systems are increasingly complex and global, having a reliable salary calculation tool is essential. Pay-Calculator delivers clarity, accuracy, and confidence by helping users understand their real take-home pay. From the detailed US salary calculator to the practical net pay calculator and a wide range of country-specific tools, Pay-Calculator empowers users to make informed financial and career decisions.

For anyone seeking transparency and precision in salary calculations, Pay-Calculator stands out as a dependable and user-friendly solution.

Blog8 months ago

Blog8 months ago[PPT] Human Reproduction Class 12 Notes

- Blog8 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog8 months ago

PG TRB Botany Study Material PDF Free Download

Blog8 months ago

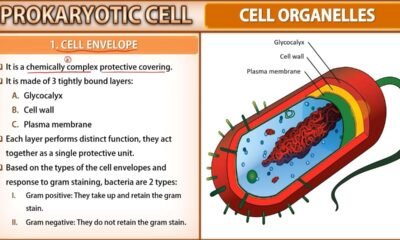

Blog8 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

Blog8 months ago

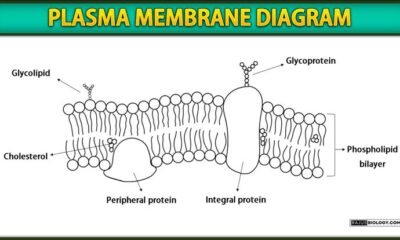

Blog8 months agoPlasma Membrane Structure and Functions | Free Biology Notes

Blog8 months ago

Blog8 months ago[PPT] The living world Class 11 Notes

Blog8 months ago

Blog8 months agoJulus General Characteristics | Free Biology Notes

Blog8 months ago

Blog8 months agoClassification of Algae By Fritsch (11 Classes of Algae)