Business

A Beginner’s Guide to the Commodity Market and How to Get Started

The commodity market offers a special way to balance your portfolio, even if stocks and mutual funds sometimes take centre stage. Diversification is the main rule of business. Commodities, which range from gold and silver to crude oil and farm goods, are material resources that support daily life and businesses. Gaining a knowledge of how this market works might help you take advantage of possibilities to preserve your wealth during unclear times and protect against inflation.

What Drives Commodity Prices?

Commodity prices are affected by global supply and demand, in contrast to stocks, which are based on business success. While global conflict might cause crude oil prices to jump, a bad rainfall can cause wheat or cotton prices to soar. In a similar way, buyers frequently move towards safe-haven metals like gold due to economic uncertainty. For example, the current gold rate in Chennai is not merely a local figure; it also takes into account trade taxes, currency moves, and world trends. Any metal seller must pay attention to these global signs.

Types of Commodities You Can Trade

Hard and soft goods are the two main groups into which the market is split. Natural materials like gold, silver, crude oil, and natural gas that are dug or harvested are known as hard commodities. Agricultural things including wheat, coffee, sugar, and cotton are examples of soft commodities. The selling of these commodities is made easy in India by platforms like MCX (Multi Commodity Exchange) and NCDEX (National Commodity and Derivatives Exchange), which let you bet on price movements without actually having the wheat sacks or oil barrels.

Why Consider Commodities?

Commodity purchases are an effective price hedge. Raw material prices usually grow in line with rising living expenses, protecting your spending power. Furthermore, there is frequently little link between goods and the stock market. This implies that commodities may stay steady or even increase during times of instability or fall in stocks, serving as a buffer for your entire portfolio.

How to Get Started

It is simple to join the commodities market. Opening a commodity dealing account with a registered exchange, such as AngelOne, is the first step. You can trade futures contracts, which are deals to buy or sell a certain amount of a good at a set price on a future date, after your account is active. This allows you to profit from price changes with a fairly small cushion.

Managing Risks

Commodities have a huge potential for profit, but they can also be risky. Unexpected events like natural disasters or rapid governmental changes might cause prices to vary greatly. Risk control is therefore important. You can safely travel the market by starting with small amounts and setting stop-loss orders. You can avoid making rash choices by keeping up with price-influencing factors, such as the today gold rate in Chennai or decreases in world oil supply.

Ultimately, discipline and ongoing learning are necessary for successful trading. You may turn commodities from a complicated idea into a strategic asset for long-term financial development by keeping an eye on market patterns and comprehending the economic elements that influence prices.

Blog8 months ago

Blog8 months ago[PPT] Human Reproduction Class 12 Notes

- Blog8 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog8 months ago

PG TRB Botany Study Material PDF Free Download

Blog8 months ago

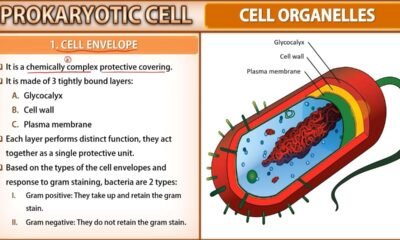

Blog8 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

Blog8 months ago

Blog8 months ago[PPT] The living world Class 11 Notes

Blog8 months ago

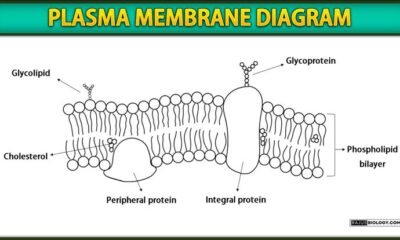

Blog8 months agoPlasma Membrane Structure and Functions | Free Biology Notes

Blog8 months ago

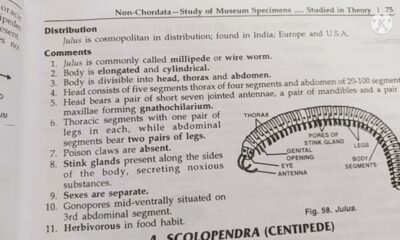

Blog8 months agoJulus General Characteristics | Free Biology Notes

Blog8 months ago

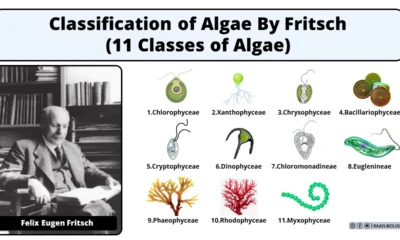

Blog8 months agoClassification of Algae By Fritsch (11 Classes of Algae)