Business

Fees Must Be Transparent to Be Safe: The Complete Guide to Mobile Payment Cashing Company Fees

When you urgently need cash and turn to mobile payment cashing, you have two primary concerns: “How fast can I get the money?” and, just as importantly, “How much will it actually cost me?” While the incredible speed of the service is its main attraction, the “fee” (수수료) is the most critical, and often the most confusing, factor for users. It is the single element that determines the true value of the transaction and, more importantly, the integrity of the provider.

The mobile payment cashing market is saturated with companies all vying for your attention, advertising a wide spectrum of fees. Some promise impossibly low rates, while others obscure their costs in confusing terms, making it difficult for consumers to make a safe and informed decision. The reality is that a provider’s fee structure 소액결제 업체 수수료 알아보기 is a direct reflection of their business ethics.

This article serves as your definitive guide to understanding these crucial fees. We will break down exactly why fees are necessary, expose the hidden traps behind “lowest fee” advertisements, provide you with the tools to judge what is fair and reasonable, and demonstrate how a transparent and trustworthy provider like FamilyPayBank operates.

Why Do Fees Exist? The Economics of an Instant Service

To intelligently assess a fee, you must first understand why it is an essential part of any legitimate mobile payment cashing service. A provider that claims to offer “zero fees” is almost certainly not a legitimate business. The fee is not pure profit; it covers several critical operational costs.

- Payment Gateway (PG) Fees: This is the largest and most overlooked cost. When you make a payment with your mobile phone, that transaction is processed by a Payment Gateway company (like KG INICIS or NHN KCP). These PG companies charge the service provider a percentage for every single transaction they process. A significant portion of the fee you pay goes directly to covering this mandatory cost.

- Operational Costs: A legitimate business has real expenses. This includes salaries for the 24/7 customer support team that assists you, costs for maintaining a secure and high-performance website and automated systems, marketing expenses to reach new customers, and other general administrative overhead.

- Risk Management: The service provider assumes a degree of financial risk. They provide you with cash instantly, but they do not receive reimbursement from the telecom companies until the next monthly billing cycle. They also bear the financial risk associated with fraudulent transactions and payment processing errors. The fee helps to mitigate this risk.

- Business Profit: Finally, yes, a portion of the fee is the provider’s profit margin. This is what allows the business to survive, reinvest in better technology, improve customer service, and continue to offer a reliable service in the long term.

Understanding this shows that a reasonable fee is a sign of a healthy, sustainable, and legitimate business.

The Trap of “Lowest Fee” Advertisements

You will inevitably see bold advertisements promising “the industry’s lowest fees” or single-digit percentage rates. While tempting, these are the biggest red flags in the market and often conceal dangerous traps.

- The Bait-and-Switch: The most common tactic is to lure you in with a low advertised rate, only to tack on hidden charges at the final stage of the process. They might call them “service charges,” “processing fees,” or “VAT,” effectively inflating the cost far beyond the initial quote. You only discover the true cost after you’ve already invested time and provided your information.

- The Information Phishing Scheme: Many fraudulent operators have no intention of providing the service at all. The low fee is simply bait to achieve their real goal: stealing your personal and financial information for identity theft or other criminal activities.

- The False Promise: An unsustainably low fee often means the provider is cutting corners elsewhere. This can manifest as extremely poor or non-existent customer service, unreliable and slow deposit times, or insecure data handling practices.

The Golden Rule: You must prioritize transparency and safety above the advertised rate. A slightly higher, clearly explained fee from a reputable and long-standing company is infinitely safer and more valuable than a dubious “low fee” from a suspicious source.

Criteria for Judging a Reasonable and Fair Fee

So, how can you, as a consumer, determine if a fee is fair? It’s not about finding the absolute lowest number, but about finding a provider who operates with honesty and clarity. Use these criteria:

- Absolute Transparency is Non-Negotiable: This is the most important factor. Before you agree to anything, the provider must be able to answer this question with a precise number: “If I cash out ₩300,000, what is the exact final amount in Won that will be deposited into my bank account?” If they hesitate, give a vague range, or say “it depends,” end the conversation immediately.

- Fees are Deducted, Never Paid Upfront: A legitimate provider’s fee is always deducted from the amount being cashed out. You will never be asked to pay any fee separately or in advance. Any request for an upfront payment is a definitive sign of a scam.

- Consistency and Professionalism: The fee structure should be consistent. It shouldn’t suddenly change based on the time of day or because you seem particularly urgent. A professional provider has a standard business policy that applies to all customers equally.

- Alignment with Industry Standards: While fee percentages can fluctuate slightly with market conditions, legitimate businesses have similar underlying cost structures (PG fees, etc.). Therefore, their final fees will generally fall within a comparable and reasonable range. A provider whose fees are drastically lower or higher than the competition warrants extreme caution.

FamilyPayBank’s Transparent and Principled Fee Policy

At FamilyPayBank, we built our service on the principle that trust begins with transparency. We believe our customers deserve to know exactly what they are paying for, without any surprises.

- Our Promise: No Hidden Costs. Ever. When you receive a quote from a FamilyPayBank consultant, that is the final, all-inclusive price. The amount we tell you that you will receive is the exact amount that will appear in your bank account. There are no hidden processing charges, no last-minute additions, and no fine print.

- A Simple, All-Inclusive Calculation: Our fee is calculated as a straightforward percentage of the transaction amount. This single fee covers all the necessary costs the PG fee, our operational expenses, risk management, and our business profit. We demystify the process so you can make your decision with complete confidence.

- Providing Fair Value: We encourage you to view our service not just as a “cost,” but as a “value exchange.” The fee you pay is for a premium service: the unparalleled speed of a 5-minute deposit, the peace of mind that comes from 24/7 professional support, the absolute security of your personal data, and the reliability of a long-standing, registered business in your moment of need.

Before you make any decision, we invite you to get a free, no-obligation quote from our expert consultants. Experience the FamilyPayBank difference of complete transparency firsthand.

Conclusion: Your Fee is a Measure of Your Provider’s Integrity

In the complex world of mobile payment cashing, a service fee is much more than just a price tag. It is the clearest benchmark of a company’s honesty, transparency, and reliability. The smartest consumers are not those who hunt for the lowest advertised number, but those who seek out the clearest and most trustworthy fee structure.

Chasing a dubious low fee is a gamble with your financial safety and personal information. Instead, choose a provider who respects you enough to be completely honest about their costs. Your peace of mind is not worth compromising for a few percentage points. Choose clarity. Choose security. Choose FamilyPayBank

Blog8 months ago

Blog8 months ago[PPT] Human Reproduction Class 12 Notes

- Blog8 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog8 months ago

PG TRB Botany Study Material PDF Free Download

Blog8 months ago

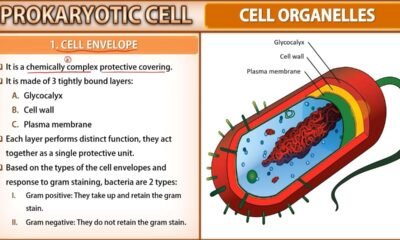

Blog8 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

Blog8 months ago

Blog8 months ago[PPT] The living world Class 11 Notes

Blog8 months ago

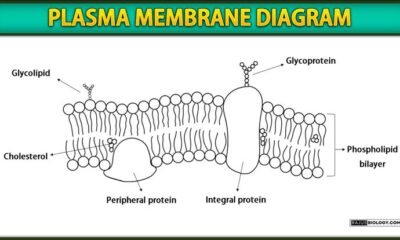

Blog8 months agoPlasma Membrane Structure and Functions | Free Biology Notes

Blog8 months ago

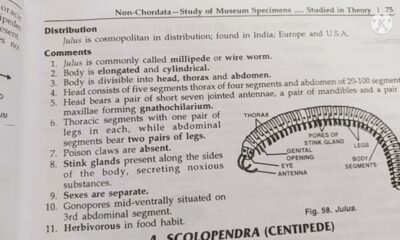

Blog8 months agoJulus General Characteristics | Free Biology Notes

Blog8 months ago

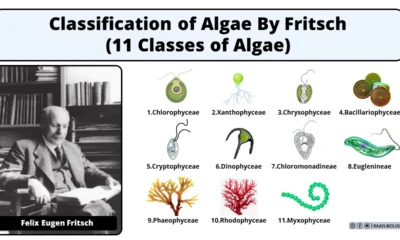

Blog8 months agoClassification of Algae By Fritsch (11 Classes of Algae)