Business

Fintechzoom.com Stoxx 600: A Comprehensive Market Overview

The financial markets have seen significant shifts over recent years, with investors continuously seeking reliable sources of market insights. Among the many indexes that track European equities, the Stoxx 600 holds a prominent position. This article explores the Stoxx 600 index in detail, highlighting its importance for investors and how fintechzoom.com serves as a vital platform for tracking its performance. Understanding the dynamics of the Stoxx 600 and leveraging fintechzoom.com can enhance your investment decisions.

What is the Stoxx 600?

The Stoxx 600 is a stock index that represents 600 large, mid, and small capitalization companies across 17 European countries. It offers broad exposure to the European equity markets and is widely regarded as a benchmark for European stocks. The index includes companies from various sectors such as technology, healthcare, financial services, and consumer goods, providing a diversified perspective on the European economy.

The composition of the Stoxx 600 is periodically reviewed to ensure it reflects market developments and investor interests. Its wide coverage makes it a preferred choice for institutional and retail investors aiming to invest in Europe’s equity markets.

You Might Also Like: Ecryptobit.com Wallets

The Importance of the Stoxx 600 in European Markets

Investors consider the Stoxx 600 as a reliable indicator of European economic health. It tracks the performance of some of the most influential companies in Europe, thereby providing a snapshot of economic trends. For portfolio managers, the index serves as a benchmark to compare the performance of their European equity funds.

Because the Stoxx 600 covers a broad range of industries and companies, it mitigates risks associated with investing in a single sector or country. Its inclusion of companies from countries like Germany, France, the United Kingdom, and the Netherlands reflects the economic diversity within Europe. This geographic and sectoral spread helps investors manage risk while benefiting from the growth prospects of multiple markets.

Tracking Stoxx 600 on Fintechzoom.com

Fintechzoom.com has become a crucial tool for investors interested in the Stoxx 600. The website offers comprehensive real-time data, news, and analysis about the index and its components. By using fintechzoom.com, investors gain access to up-to-date price movements, sector performance, dividend information, and earnings reports.

One of the strengths of fintechzoom.com is its user-friendly interface, which allows both novice and experienced investors to navigate through market data efficiently. The platform provides tools such as interactive charts and historical performance analysis, enabling users to make informed investment choices. Additionally, fintechzoom.com features expert commentaries and insights, which can help investors understand the broader market implications of Stoxx 600 movements.

Sectoral Composition and Its Impact on Stoxx 600

The Stoxx 600 is composed of companies from several key sectors. Technology firms within the index have shown robust growth, driven by innovation and increased digital adoption across Europe. Financial services companies, including banks and insurance firms, represent a significant portion of the index, reflecting Europe’s deep financial markets. Consumer goods and industrial sectors also play a vital role in shaping the index’s performance.

Changes in global economic conditions, such as interest rate shifts or geopolitical tensions, can affect the sectors differently. For instance, rising interest rates might impact financial companies negatively but could boost returns in other sectors like energy. Monitoring sector-specific trends on fintechzoom.com helps investors anticipate such market movements and adjust their portfolios accordingly.

How Economic Events Influence the Stoxx 600

Economic indicators such as GDP growth, inflation rates, and employment figures directly impact the performance of companies within the Stoxx 600. When Europe experiences strong economic growth, companies tend to report higher earnings, which generally lifts the index. Conversely, periods of economic uncertainty or recession can lead to declines in stock prices.

Trade policies and regulatory changes across European nations also influence the Stoxx 600. For example, decisions related to Brexit created volatility in the index as investors reassessed risks and opportunities associated with the United Kingdom’s exit from the European Union. By staying updated through fintechzoom.com, investors can better understand how such macroeconomic factors affect their investments.

Investment Strategies Using the Stoxx 600

There are multiple ways to invest in the Stoxx 600. Investors can purchase index funds or exchange-traded funds (ETFs) that replicate the performance of the Stoxx 600, providing broad exposure to the European market without the need to pick individual stocks. This passive investment strategy suits those who prefer a diversified portfolio with lower fees.

Alternatively, active investors might use the Stoxx 600 as a starting point for stock selection. By analyzing individual companies within the index on fintechzoom.com, investors can identify opportunities for growth or undervalued stocks. The detailed financial data and news available on fintechzoom.com make this process more efficient and informed.

Risks Associated with Investing in the Stoxx 600

Despite its diversification, investing in the Stoxx 600 carries certain risks. Currency fluctuations can affect returns for investors outside the Eurozone. Since the index includes companies from multiple countries with different currencies, changes in exchange rates may impact investment outcomes.

Market volatility and geopolitical events can also introduce risk. Sudden political shifts, regulatory changes, or unexpected economic downturns can lead to rapid changes in stock prices. Using fintechzoom.com to monitor news and market data helps investors react promptly to these risks.

Comparing Stoxx 600 with Other European Indexes

While the Stoxx 600 is comprehensive, there are other European indices like the DAX, CAC 40, and FTSE 100 that focus on specific countries or sectors. The Stoxx 600 offers a broader view, making it a preferred choice for those seeking wide market exposure.

Investors often compare performance across these indices to identify regional strengths or weaknesses. Fintechzoom.com provides comparative data, making it easier to assess how the Stoxx 600 stands relative to other indices. This comparative analysis is valuable for constructing balanced portfolios.

Future Outlook for the Stoxx 600

Looking ahead, the Stoxx 600 is expected to remain a key benchmark for European equities. As Europe continues to recover from economic challenges and invests in innovation and sustainability, companies in the index are positioned to benefit. Trends such as green energy transition, digital transformation, and increased consumer spending are likely to shape the index’s performance.

Investors should continue using fintechzoom.com to track these evolving trends. The platform’s timely updates and expert insights will remain critical for understanding the future trajectory of the Stoxx 600.

Conclusion

The Stoxx 600 serves as a vital tool for investors seeking exposure to the European equity markets. Its broad composition and sectoral diversity offer a comprehensive view of Europe’s economic landscape. Fintechzoom.com plays an essential role in providing timely and detailed market data, enabling investors to make informed decisions.

By understanding the structure, risks, and opportunities within the Stoxx 600, and by leveraging fintechzoom.com, investors can navigate the complexities of the European stock markets more confidently. Staying informed through reliable platforms is key to capitalizing on the potential of the Stoxx 600 in an ever-changing financial environment.

Blog8 months ago

Blog8 months ago[PPT] Human Reproduction Class 12 Notes

- Blog8 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog8 months ago

PG TRB Botany Study Material PDF Free Download

Blog8 months ago

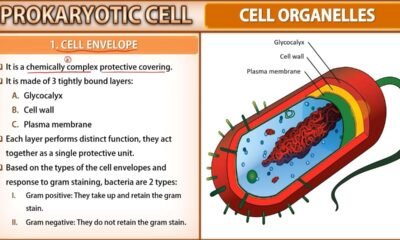

Blog8 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

Blog8 months ago

Blog8 months ago[PPT] The living world Class 11 Notes

Blog8 months ago

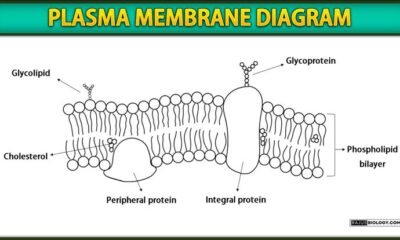

Blog8 months agoPlasma Membrane Structure and Functions | Free Biology Notes

Blog8 months ago

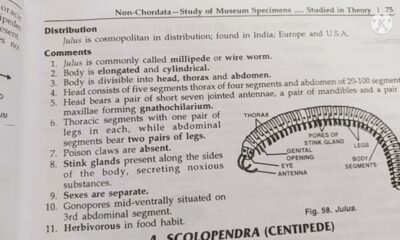

Blog8 months agoJulus General Characteristics | Free Biology Notes

Blog8 months ago

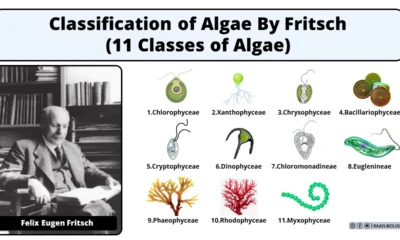

Blog8 months agoClassification of Algae By Fritsch (11 Classes of Algae)