Blog

Miflow Login: Guide for Seamless User Access

In today’s fast-paced digital landscape, the need for streamlined, secure, and user-friendly platforms is greater than ever. Whether you’re managing loans, accessing financial records, or updating client information, centralized digital tools are essential. The miflow login portal has emerged as a critical component in the digital transformation of loan and financial management systems. Used primarily by financial institutions and their employees, the miflow login system offers an efficient pathway to manage workflows, customer data, and operational records within a secure and organized environment.

The Purpose and Importance of Miflow

Miflow is designed to support the backend operations of financial services, particularly those involved in loan processing and account tracking. It plays a vital role in ensuring that data is recorded accurately, updated in real time, and made accessible only to authorized personnel. The miflow login system is where this secure access begins, serving as the gateway for users to enter the digital workspace. For employees of institutions using Miflow, logging in is a daily routine that connects them to client data, transaction updates, verification records, and workflow statuses.

How the Miflow Login Process Works

The process of accessing the miflow login portal is straightforward but follows stringent security protocols. Users are typically assigned unique credentials, including a username and password, which are required for authentication. Some institutions may also incorporate two-factor authentication (2FA) for enhanced protection. Once users reach the login page, entering the correct credentials grants them access to their personalized dashboard, from where they can manage all assigned tasks.

The miflow login system is optimized for both desktop and mobile access, ensuring that users can log in and work remotely when necessary. This flexibility is crucial in the modern financial industry, where remote operations and timely data entry are increasingly common and necessary.

Security Features and Data Integrity

One of the standout features of the miflow login environment is its commitment to security. Financial data is highly sensitive, and protecting this information from breaches is a top priority. The miflow login system incorporates encrypted connections, role-based access control, and user-specific dashboards to ensure that only authorized users can access certain types of information.

Each login session is monitored and recorded to create a detailed log history, which can be audited if needed. These security measures ensure the system’s reliability and prevent unauthorized access, making miflow login one of the safer portals in the financial service sector.

User Interface and Experience After Logging In

Once inside the system, users are welcomed by a clean and intuitive dashboard. Designed for clarity and usability, the user interface presents modules such as loan tracking, client information, document upload features, verification tools, and communication logs. All these are designed to streamline workflow efficiency and reduce the time spent navigating between tools.

The miflow login portal does not only grant access—it also personalizes the experience. Depending on the user’s role within the organization, certain features may be highlighted or hidden. Loan officers, for instance, may see different data panels compared to branch managers or administrative staff.

Role-Based Access Control in the Miflow System

Miflow utilizes a highly structured role-based access control system. This means that users will only see the information and features relevant to their assigned roles. For instance, a junior executive may be able to input customer data but not approve loan disbursements. In contrast, a senior manager may have access to all workflow data and the ability to generate reports.

The miflow login credentials issued to users are directly tied to these roles. This minimizes the risk of errors or security breaches and also ensures that operational responsibilities remain clearly defined across the organization.

Typical Issues Faced During Login and Their Solutions

As with any digital system, users occasionally encounter issues during the miflow login process. These may include forgotten passwords, account lockouts due to multiple failed attempts, browser compatibility problems, or expired sessions. Fortunately, Miflow has in place a set of standard protocols to help users regain access without compromising system security.

Password recovery tools are available directly on the login page. In cases of lockout, IT support teams within the organization can reset accounts upon proper verification. The system is compatible with all major browsers, but users are encouraged to keep their browsers updated to avoid interface glitches during the miflow login process.

Mobile Accessibility and App Integration

As the workforce becomes increasingly mobile, access to financial systems via smartphones and tablets is no longer optional—it is essential. Miflow addresses this need through a mobile-friendly version of the portal, allowing users to perform critical operations without being tied to a desktop.

While a dedicated mobile app may not be available for all institutions using Miflow, the responsive design ensures smooth interaction via mobile browsers. Mobile access is particularly useful for field officers and sales teams who may need to access or update information on the go. The miflow login functionality on mobile mirrors the desktop version in terms of security and features, offering consistency and convenience.

Real-Time Data Sync and Workflow Automation

One of the most powerful features unlocked after the miflow login process is real-time data synchronization. The system automatically updates records as they are entered, reducing the chances of duplication or outdated information. This real-time sync supports faster decision-making and keeps all departments aligned.

In addition, Miflow supports workflow automation features such as task reminders, auto-approvals based on pre-set rules, and notifications. These tools reduce the need for manual intervention in routine tasks and improve operational efficiency. After a successful miflow login, users can configure their dashboards to prioritize the tasks most relevant to them.

Compliance and Documentation Standards

Financial institutions must adhere to strict regulatory guidelines regarding documentation, data handling, and reporting. Miflow supports these compliance requirements by providing built-in documentation management features. After the miflow login, users can upload, view, and verify documents linked to each client profile.

Audit trails are maintained for every action taken within the system. This includes edits to records, loan disbursements, approvals, and any changes in client status. These features are essential for maintaining transparency and proving compliance during audits and inspections.

Training and Onboarding for New Users

Effective use of the miflow login system begins with proper training. Organizations using Miflow typically provide onboarding sessions for new employees, which include navigation tutorials, data entry protocols, and security guidelines. Some institutions may also offer certifications for proficiency in Miflow, further enhancing the system’s credibility as an essential workplace tool.

For continuous learning, many Miflow platforms feature built-in help centers or links to training videos. This ensures that users remain up to date with the latest system upgrades or changes, thereby maintaining productivity and reducing downtime caused by user errors.

Customer Support and IT Assistance

When issues arise, having access to quick and competent support is crucial. The miflow login portal often includes links to customer service or internal IT support channels. Depending on the organization’s structure, support may be provided by in-house technical teams or outsourced to third-party vendors.

Support includes help with password resets, access restoration, bug reporting, and customization of user roles. Institutions that prioritize training and responsive support see fewer disruptions in workflow and better system adoption among their staff.

Data Analytics and Reporting Tools

Once logged into Miflow, users can generate various reports related to loan status, client performance, application turnarounds, and compliance metrics. These analytics tools are an essential part of decision-making processes for managers and executives. Data visualizations help identify trends, flag operational bottlenecks, and create strategic roadmaps.

The miflow login dashboard typically includes shortcuts to these reporting tools, making them easy to access and use. With customizable filters and export options, users can tailor reports for internal meetings or regulatory submissions.

Integration with Other Digital Systems

Miflow does not operate in isolation. It is often integrated with customer relationship management systems (CRM), enterprise resource planning tools (ERP), and accounting software. These integrations ensure a seamless data flow across various departments, eliminating redundancies and improving accuracy.

After the miflow login, users can often switch between these integrated systems without logging out, thanks to single sign-on (SSO) capabilities. This interoperability enhances productivity and makes Miflow a central hub for operational management.

System Updates and Version Control

To stay ahead in the rapidly evolving digital environment, Miflow regularly updates its software. These updates might include user interface improvements, additional security features, or new workflow tools. Institutions using Miflow are typically notified about updates in advance, and the process is carried out with minimal disruption.

Version control also ensures that all users are working on the most current and compatible version of the platform. This reduces bugs, enhances performance, and improves the overall user experience of the miflow login system.

Conclusion: Enhancing Efficiency Through Miflow Login

The miflow login system represents more than just a portal—it is the gateway to an integrated, efficient, and secure operational platform tailored for financial institutions. It simplifies complex processes, enhances data security, and empowers users to perform their roles with greater accuracy and speed. From remote access to robust analytics and compliance tools, Miflow supports every facet of a modern financial organization’s backend operations.

As digital transformation continues to shape industries, tools like Miflow will play a central role in determining how efficiently institutions can serve their clients and meet regulatory standards. With secure access, real-time updates, and a user-friendly interface. The miflow login experience sets a high standard for operational platforms in the financial sector.

Blog8 months ago

Blog8 months ago[PPT] Human Reproduction Class 12 Notes

- Blog8 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog8 months ago

PG TRB Botany Study Material PDF Free Download

Blog8 months ago

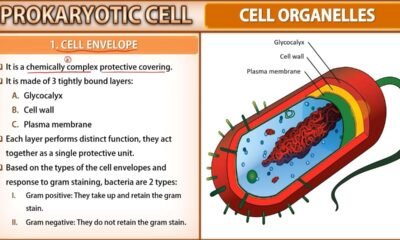

Blog8 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

Blog8 months ago

Blog8 months ago[PPT] The living world Class 11 Notes

Blog8 months ago

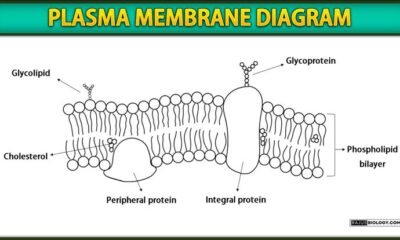

Blog8 months agoPlasma Membrane Structure and Functions | Free Biology Notes

Blog8 months ago

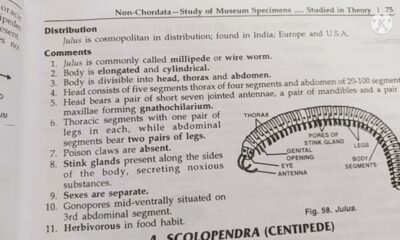

Blog8 months agoJulus General Characteristics | Free Biology Notes

Blog8 months ago

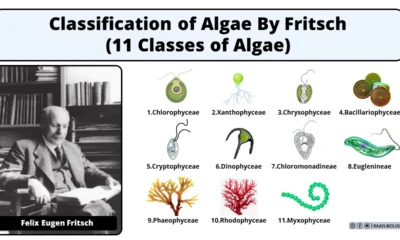

Blog8 months agoClassification of Algae By Fritsch (11 Classes of Algae)