Finance

Quantum AI: A Comprehensive Guide for Modern Investors

The financial world is evolving at a pace that has never been seen before. Over the past decade, digital platforms, algorithmic trading, artificial intelligence, and automation have significantly changed how people invest and manage wealth. Today, a new layer of technological progress is emerging — the integration of quantum-inspired systems and AI-enhanced trading logic. This breakthrough approach, often referred to as Quantum AI, represents a shift toward faster data processing, improved pattern recognition, and smarter decision support for traders of all experience levels.

For individuals aged 35 and above, the attraction is clear: less time spent interpreting complex charts, fewer emotional errors, and a more structured approach to making financial decisions. As economies change and volatility becomes more common, having access to tools that provide enhanced analytical precision can be an advantage. Quantum AI technology is designed to deliver exactly that.

What Quantum AI Means in the Modern Trading Landscape

Quantum AI is not about replacing human insight. Instead, it aims to combine human judgment with computational strength. In a traditional trading environment, investors rely on indicators, news, and market cycles. Even with extensive experience, the complexity of global markets makes it difficult to process everything quickly. Quantum-inspired AI systems help by analyzing large data sets simultaneously, identifying correlations, and generating insights that support better timing and risk management.

Platforms associated with this new wave of financial technology, such as those behind AI platform solutions in Europe, serve as gateways for individuals interested in automated and semi-automated strategies. These systems aim to simplify tasks that would normally require hours of manual evaluation. For users in countries like Germany, services provided by resources such as quantenkioffizielle.de offer access to structured AI-based investment workflows. French users, on the other hand, may explore the solutions offered through quantumaiofficiel.fr. On a global scale, the main portal available at quantumaiofficial.com introduces the technology to a broader audience.

How Quantum AI Enhances Analytical Precision

Real-Time Data Processing

Financial markets move quickly, often reacting within milliseconds to economic news, geopolitical announcements, or fluctuations in supply and demand. A human trader cannot process these rapid patterns in real time, but AI-supported systems can. Quantum-inspired models evaluate incoming data streams instantly, helping users keep pace with market momentum rather than reacting after the fact.

Multi-Layered Evaluation

Instead of focusing on one type of signal, these technologies review multiple variables at once: price movements, candlestick patterns, macroeconomic indicators, sentiment trends, seasonal behaviors, and more. This broader perspective reduces the likelihood of incomplete analysis and supports decision-making that accounts for various risk factors.

Consistency and Discipline

One of the greatest challenges for investors over 35 is balancing personal responsibilities with the demands of active trading. Quantum AI systems provide consistent processing even when the user is not available. This consistency helps minimize emotional decision-making, which can lead to overtrading, chasing losses, or exiting positions too early.

Why Investors Aged 35+ Are Turning to Quantum AI

Time Efficiency

Career responsibilities, family commitments, and long-term financial planning often reduce the time available for constant market monitoring. Quantum AI offers a structured approach, delivering insights without demanding continuous attention.

Reduced Emotional Bias

Emotional reactions can undermine even experienced investors. Fear, excitement, and impatience can distort judgment. Quantum AI tools provide insights derived from data, minimizing the emotional component and supporting more stable decision-making.

Accessibility to Advanced Analysis

In the past, only financial institutions could access systems capable of processing large volumes of data quickly. Quantum-inspired AI brings this capability directly to private investors through intuitive interfaces, guidance features, and user-friendly dashboards.

Key Features Commonly Found in Quantum AI Trading Platforms

Pattern Recognition

Market patterns often repeat across cycles, whether bullish, bearish, or sideways. Quantum AI technologies excel at identifying these repeating structures. The system may highlight trends earlier than traditional indicators, helping users make timely decisions.

Risk Assessment Tools

Modern platforms place significant emphasis on capital preservation. Tools often include position size suggestions, stop-loss recommendations, and volatility analysis. These features help reduce exposure during unstable market conditions.

Portfolio Automation

Some services allow semi-automated or fully automated portfolio management. Users can set preferences, risk levels, and strategy parameters. The AI system then monitors market conditions and reacts according to the user’s chosen approach.

User-Friendly Interface

For audiences aged 35 and older, clarity and simplicity matter. Trading platforms incorporating Quantum AI technology often include clean dashboards, easy-to-read charts, and a step-by-step setup process. This reduces the learning curve and supports long-term use.

Applications of Quantum AI in Different Trading Styles

Long-Term Investing

Investors who prefer long-term strategies benefit from deep market analysis and trend evaluation. Quantum AI enhances this approach by identifying structural shifts early, providing users with macro-level insights.

Short-Term and Intraday Trading

Speed is essential in fast-moving markets. Quantum AI systems support this by processing live data streams and highlighting opportunities instantly.

Diversified Portfolio Management

With the ability to analyze multiple assets at once, AI tools help investors diversify strategically. This includes stocks, indices, cryptocurrencies, commodities, and foreign exchange pairs.

Regional Adoption: Germany, France, and International Markets

Germany

German investors are known for their methodical, risk-conscious approach. Platforms accessible through quantenkioffizielle.de emphasize security, reliability, and regulatory awareness. The German market has seen steady interest in automated financial tools, particularly among investors aged 35 to 55.

France

French users exploring AI-assisted trading can access solutions through quantumaiofficiel.fr. The French market values transparency and ease of use. Quantum AI systems appeal to individuals seeking structured guidance and improved efficiency.

International Access

For global users, the primary resource at quantumaiofficial.com provides a universal introduction to this category of AI technology. The platform helps newcomers understand features, usability, and the overall capabilities available.

How Quantum AI Supports Smarter Decision-Making

Scenario Simulation

Quantum-inspired logic allows systems to simulate possible outcomes before generating insights. This “predictive horizon” helps users anticipate movements rather than responding after changes occur.

Adaptable Strategies

Instead of following a rigid set of instructions, Quantum AI adapts to evolving conditions. When volatility increases, it may adjust its recommendations. When markets stabilize, it may focus more on growth trends.

Comprehensive Market Coverage

A modern investor must evaluate multiple markets. Quantum AI simplifies this by watching various asset classes and presenting opportunities in a consolidated format.

Improving Confidence for Investors Over 35

Many individuals in this age group are focused on strengthening financial stability and planning for the future. Quantum AI appeals to them because it offers:

Greater clarity and structure

Insights backed by data

Reduced reliance on guesswork

Better understanding of risk exposure

Support for diversified strategies

This combination helps users make decisions with more confidence, especially during unpredictable market periods.

Factors to Consider Before Using a Quantum AI Trading Platform

Understanding the Technology

While the platforms simplify the experience, users benefit from having a basic understanding of how AI-driven analysis works. This helps set realistic expectations.

Risk Tolerance

Investing always involves risk. Quantum AI provides insights, not guarantees. Users should select risk settings that match their comfort level and financial goals.

Consistent Monitoring

Even with automated assistance, reviewing performance periodically is essential. This ensures alignment between the system’s actions and the investor’s long-term objectives.

Platform Selection

Different platforms offer different tools and features. Users should evaluate interface clarity, available asset classes, customer support, and regulatory alignment.

The Future of Quantum AI in Personal Investing

As technology continues to evolve, the role of Quantum AI in investment decision-making is set to expand. The next decade may include:

Broader access to advanced financial tools for private investors

More refined risk-management algorithms

Greater integration with mobile and voice-activated platforms

Even faster data processing as quantum computing matures

More adaptive systems capable of learning user preferences

For investors focused on long-term financial growth, understanding and adopting AI-enhanced tools early may provide an advantage.

Final Thoughts

Quantum AI represents a new chapter in the evolution of personal finance. It blends computational efficiency with practical decision support, offering investors aged 35 and above a smarter, more structured approach to trading and portfolio management. Whether a user explores the German-focused platform at quantenkioffizielle.de, the French portal at quantumaiofficiel.fr, or the global resource at quantumaiofficial.com, the goal remains the same: making data-driven financial decisions with improved clarity, reduced stress, and better long-term outcomes.

Blog8 months ago

Blog8 months ago[PPT] Human Reproduction Class 12 Notes

- Blog8 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog8 months ago

PG TRB Botany Study Material PDF Free Download

Blog8 months ago

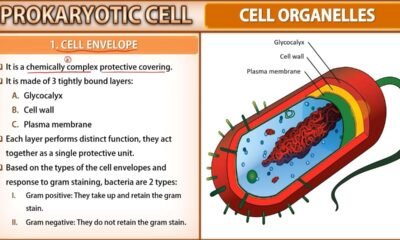

Blog8 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

Blog8 months ago

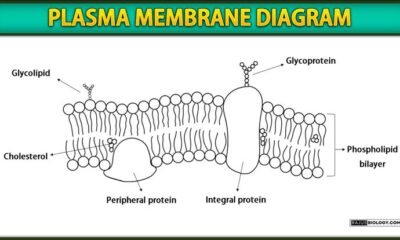

Blog8 months agoPlasma Membrane Structure and Functions | Free Biology Notes

Blog8 months ago

Blog8 months ago[PPT] The living world Class 11 Notes

Blog8 months ago

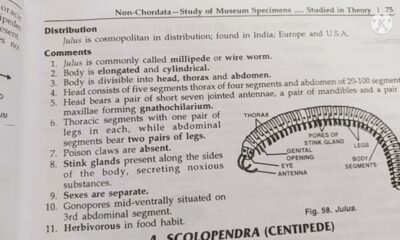

Blog8 months agoJulus General Characteristics | Free Biology Notes

Blog8 months ago

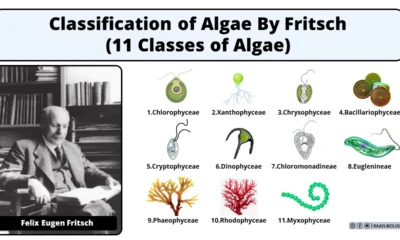

Blog8 months agoClassification of Algae By Fritsch (11 Classes of Algae)