Blog

Sending Money to India? Here’s a Smarter Path for U.S. SMEs!

For US small and mid-sized enterprises expanding operations to include Indian suppliers and business partners, international payments give rise to both opportunities and obstacles. Cross-border payments take 55% longer than domestic payments for US businesses, while the global average cost of sending international payments stands at 6.26% of the amount sent .

Five Critical Pain Points Plaguing US-India B2B Payments

1. Extended Processing Times That Disrupt Operations

International transfers to India average 18 hours and 18 minutes . Analysis of 2,000 SWIFT transactions reveals that 75% of international payments involve at least one intermediary financial institution . When intermediary institutions are involved, processing times extend to an average of 1 day, 11 hours, and 15 minutes .

2. High and Hidden Costs That Erode Profit Margins

Usually, levy charges between $20 and $75 per transaction are imposed for cross-border payments using the SWIFT network . Currency conversion represents the largest hidden expense, with institutions typically applying a 2-4% markup on the exchange rate . For a $50,000 payment to an Indian vendor, a 1% markup results in a loss of ₹41,000 (approximately $500).

3. Complex Compliance Requirements

US SMEs making payments to India must navigate two distinct regulatory frameworks simultaneously. The United States requires compliance with Anti-Money Laundering (AML) rules, counter-terrorism financing (CTF) standards, and Know Your Customer (KYC) requirements.

4. Limited Payment Tracking and Transparency

Traditional international payment systems provide minimal visibility into transaction progress. With an average of 1.31 intermediaries per transaction, payments pass through multiple institutions before reaching their destination. This opacity particularly affects US SMEs working with Indian suppliers on time-sensitive projects.

5. Cash Flow Impact from Unpredictable Costs

The combination of unpredictable processing times and hidden costs creates significant cash flow challenges for US SMEs. What starts as a simple wire payment can quickly snowball with unexpected fees—from correspondent bank charges to unfavorable currency conversion rates—leaving businesses paying far more than they planned.

The Modern Solution: OnlineCheckWriter.com – Powered by Zil Money

OnlineCheckWriter.com – Powered by Zil Money addresses each pain point with a platform designed for modern international business. Rather than accepting traditional infrastructure limitations, the platform leverages blockchain technology and direct settlement mechanisms.

The Feature Tree: Strength That Grows from the Core

At the root of the platform is a strong, reliable payment engine designed for scale. From this base grows a robust feature tree, with each branch serving a key business need.

Fast Settlements

One of the most powerful branches is speed. Payments don’t linger for days—they’re settled in minutes. Whether funds are headed to Europe, Asia-Pacific, or beyond, this branch ensures business keeps moving without delay.

No Prefunding Required

Traditional systems often demand advance deposits into foreign accounts, tying up working capital. This platform eliminates that. Payments are made directly from your wallet, allowing your funds to work smarter, not sit idle.

Multi-Currency Support :

The next branch supports payments in multiple currencies. By leveraging live exchange rates, the system gives businesses precise control over transactions without the need to manage multiple conversion processes or additional infrastructure.

High Security

A branch built for peace of mind. The system is secured with layered encryption, fraud detection, and infrastructure-level safeguards, so every transaction is protected from end to end.

Easy Access and Control

Whether on a desktop or mobile device, users can initiate, track, and manage payments from anywhere. The interface is designed to be intuitive without compromising functionality. Access is instant, and oversight is crystal clear.

Seamless Payment Management

This final branch ensures funds go where and when they’re needed. No manual uploads, no delays from third-party platforms—just clean, efficient global payments integrated into your workflow.

Together, the feature tree supports the full spectrum of international payment needs, from occasional cross-border transactions to routine global operations.

Supporting US-India Business Growth

OnlineCheckWriter.com – Powered by Zil Money bridges the gap between traditional payment infrastructure and modern business needs. Whether sending funds to software development teams in Hyderabad, manufacturing partners in Chennai, or service providers in Delhi, the process remains consistent and predictable.

Try OnlineCheckWriter.com – Powered by Zil Money today and experience how international payments should work for modern business partnerships.

Frequently Asked Questions :

- How fast are international payments with this platform?

Most international payments are completed within minutes, thanks to advanced blockchain settlement technology.

- Is pre-funding required to send global payments?

Payments are directly settled from your wallet—there’s no need to pre-fund foreign accounts or manage separate balances.

- Can payments be made in different currencies?

The platform supports multiple currencies with live exchange rates, making it easy to send accurate, flexible payments worldwide.

Blog8 months ago

Blog8 months ago[PPT] Human Reproduction Class 12 Notes

- Blog8 months ago

Contribution of Indian Phycologists (4 Famous Algologist)

- Blog8 months ago

PG TRB Botany Study Material PDF Free Download

Blog8 months ago

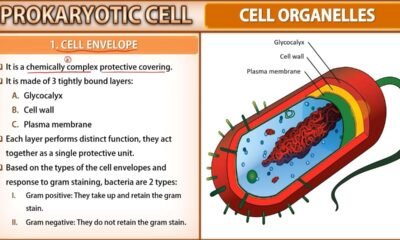

Blog8 months agoCell The Unit of Life Complete Notes | Class 11 & NEET Free Notes

Blog8 months ago

Blog8 months ago[PPT] The living world Class 11 Notes

Blog8 months ago

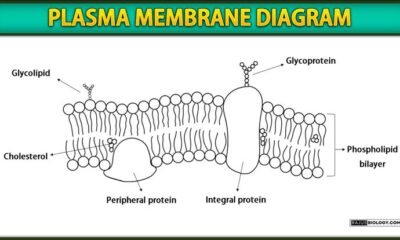

Blog8 months agoPlasma Membrane Structure and Functions | Free Biology Notes

Blog8 months ago

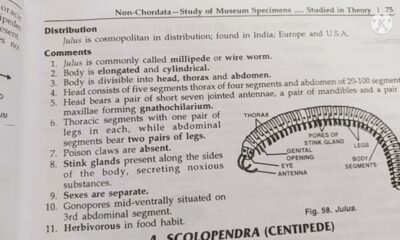

Blog8 months agoJulus General Characteristics | Free Biology Notes

Blog8 months ago

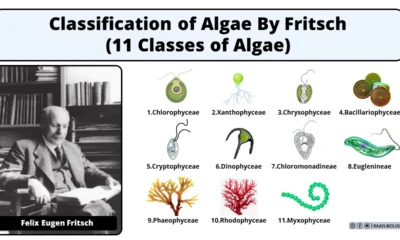

Blog8 months agoClassification of Algae By Fritsch (11 Classes of Algae)